First Solar, America’s largest solar manufacturer, launched the USA’s biggest solar research facility in Ohio in early July. Through the facility, First Solar is racing China to the solar industry’s next breakthrough – according to a report from the Financial Times (FT).

The coverage notes a belief that the US must “innovate rather than replicate China” to stay competitive in clean technologies. “We’re not going to follow this race to the bottom on pricing,” said Mark Widmar, First Solar’s chief executive to the FT.

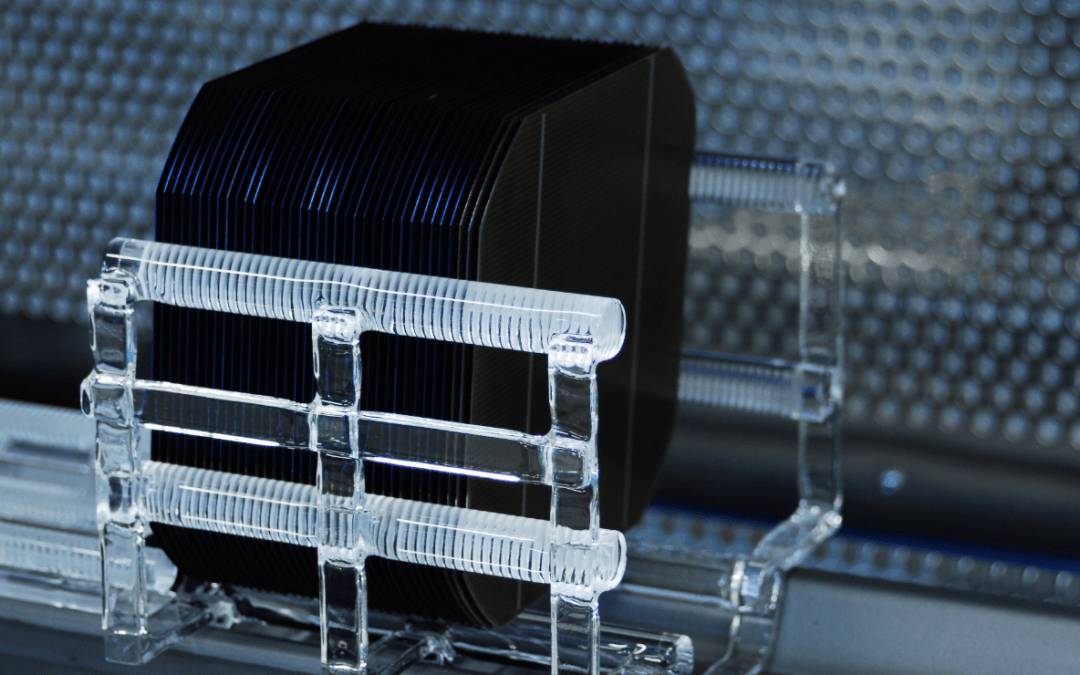

The company is investing in the research facility to the tune of USD $500m including a pilot line for the promising but unproven perovskite technology.

First Solar’s push into research contrasts sharply with other US solar manufacturers, who have recently cancelled or delayed projects due to China’s overproduction of panels, which has driven prices to concerning record lows over the last year.

This has resulted in tariffs against Chinese solar products from a range of countries, especially following a petition from US manufacturers (including First Solar) against Chinese companies potentially dumping solar cells in south-east Asia.

First Solar investment

First Solar has steadily invested $2.4bn in manufacturing, boosted by the subsidies from President Joe Biden’s Inflation Reduction Act (IRA), which provides ten-year subsidies for producers.

Data shows that these incentives have nearly doubled the company’s share price since the IRA’s enactment, though some industry members worry that First Solar may lobby for protectionist policies that could increase costs for consumers.

Despite challenges, First Solar remains a major player by a large margin, having survived the offshoring and bankruptcies that affected the US solar industry in the 2010s. Its survival is partly due to its reliance on cadmium telluride technology and a largely domestic supply chain, avoiding dependence on China.

The company’s robust research and development efforts, which saw a 35% increase in investment to $152 million in 2023, are essential for maintaining its technological edge.

However, data from the International Renewable Energy Agency shows that the US still lags behind China in solar innovation, with China filing over 9,000 solar patents last year compared to less than 350 by the US.

First Solar’s panels were less efficient and above $0.30 per watt, while the imported Chinese panels were under $0.16 per watt.

Market conditions

Market conditions need to improve for further innovation, as high costs and inefficiencies in US-made panels remain a challenge.

First Solar’s influence and the potential for job creation in the green energy sector will be tested in the upcoming US elections, particularly in Ohio, a critical state for solar manufacturing.

The outcome could impact the IRA’s future, with Trump’s running mate JD Vance threatening to “terminate” it, potentially resulting in significant implications for the domestic solar industry.

“This is an inflection point for this industry. If we are unable to establish a domestic industry under the IRA programme right now, I don’t think it ever happens,” Widmar concludes.

Solar & Storage Live USA is the place to catch up with the American and global solar industry. Register for free here.