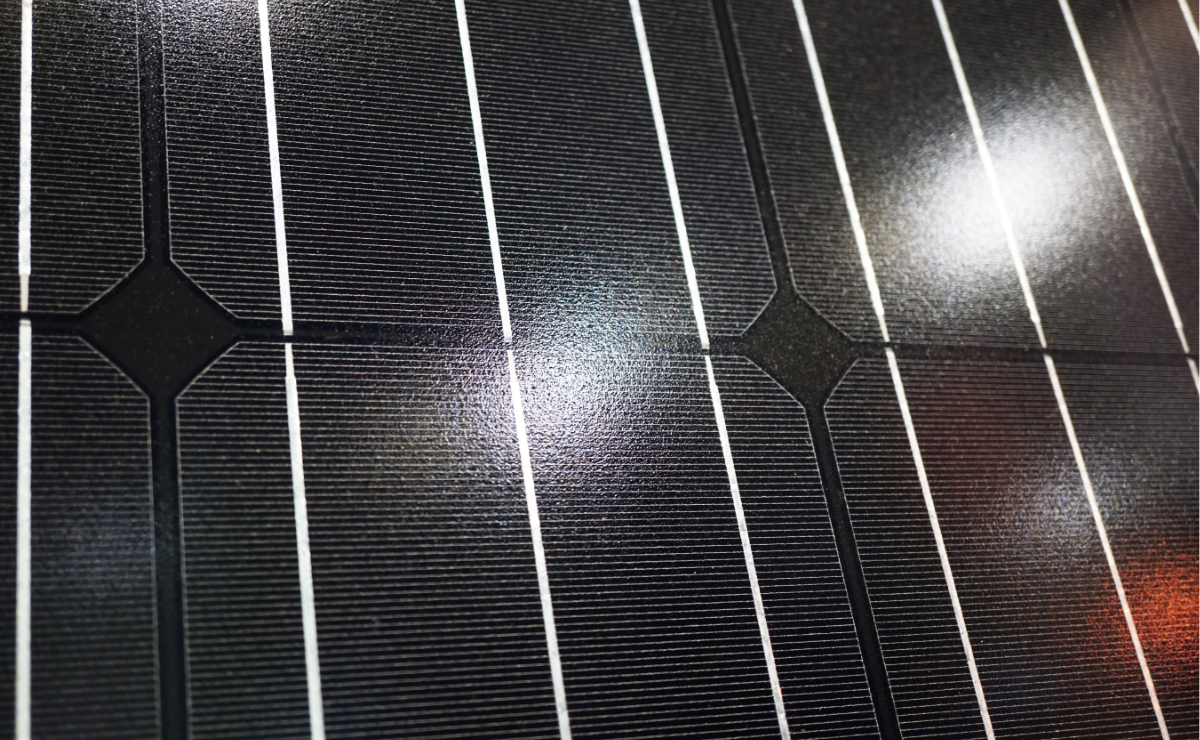

LONGi Green Energy Technology Co. has announced a strategic shift to replace silver with base metals in its solar cell production.

The move comes in response to escalating costs and intense market competition, which have pressured the industry’s profit margins.

Mass production of these base-metal solar products is scheduled to begin in the second quarter of 2026. According to a company filing on 5 January, the transition is intended to “further lower the costs of solar modules.”

The economic pressure of silver

The solar industry has long sought to reduce its reliance on silver, but recent market volatility has accelerated these efforts. According to BloombergNEF, silver now accounts for 14% of the cost of solar modules, a significant increase from 5% two years ago.

The price of silver has seen a dramatic trajectory:

- 2025 performance: The metal’s price surged 150% last year, driven by demand from the tech sector, global uncertainty, and the US Federal Reserve interest rate cuts.

- Current market: As of Tuesday, silver prices rose over 5% to approximately $80.73, nearing the all-time high of $83 recorded in late December.

- Geopolitical factors: Some analysts attribute the recent spike to China’s new export restrictions and increased global uncertainty following the US’ capture of Venezuelan president Nicolás Maduro.

China’s export restrictions

China, a dominant global producer, has limited the number of companies authorised to export silver to 44, which some analysts believe may create a “local surplus”.

Other analysts have compared the situation to previous restrictions on rare earth minerals used to maintain control over critical resources.

The restrictions have drawn criticism from industry leaders, as the metal remains vital for high-growth sectors, including electric vehicles (EVs) and AI data centres. Elon Musk, CEO of EV giant Tesla, commented on his social media platform X: “This is not good. Silver is needed in many industrial processes.”

LONGi’s pivot

LONGi’s pivot is supported by its specific focus on back-contact (BC) solar cells. While “TopCon” technology currently holds a larger market share, LONGi maintains that BC cells are better suited for material substitution.

Beyond solar cell innovation, LONGi said in its Monday statement that it will expand its new energy storage business. The company plans to focus its storage efforts on the domestic Chinese market as well as Europe, the US, and Australia.