Since October, almost $43m worth of electronics equipment from India has been detained by the US Customs and Border Protection (CBP). They have been detained under a 2022 law banning imports of goods made with forced labour.

No electronics shipments from India had been detained in previous years.

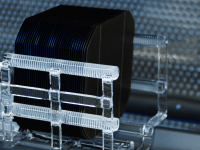

The electronics detained have not been described but likely include polysilicon, which is identified as a “high priority” under the Uyghur Forced Labor Prevention Act (UFLPA). As a raw material used in solar panels, the panels usually make up most of detained electronics shipments.

The UFLPA primarily targets China’s Xinjiang region, which is suspected to have established labour camps under government stewardship for ethnic Uyghur and other Muslim groups. China, however, has denied the allegations.

Almost a third of shipments of electronics from India were refused, compared to 5.4% of US solar shipments from Southeast Asia. Overall, $3b of electronics had been denied at the border by CBP in the last two years.

As Indian producers begin to position themselves as an option for solar project developers without navigating the tariffs and UFLPA enforcement delays that come with Chinese goods, this is a step back for their efforts.

Tim Brightbill, a trade attorney with Wiley Rein LLP, comments: “If the solar cells for Indian panels are coming from China, then there is likely a good reason why detentions of Indian products may be increasing.

“My sense is that Customs and Border Protection did not realize for a while that many Indian solar panels contained Chinese solar cells, and therefore the UFLPA risks were (and are) high.”

The news seems to follow UFLPA being expanded further than China’s producers, as trade officials suspect that the Chinese industry’s biggest players have swapped their local polysilicon providers with American and European sources to circumvent UFLPA delays and detention.

Stats

- Solar imports from India hit a new height of $2.3b in 2023

- In Q2 of 2024, 11% of panel imports to the USA came from India

- This was over double the figure from Q1