The Spanish government is advancing plans to auction 829MW of renewable generation and energy storage capacity in regions where coal plants have been decommissioned.

The Ministry for Ecological Transition and the Demographic Challenge (MITECO) has opened a public consultation on this competitive auction.

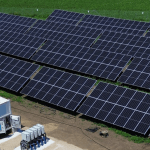

The “fair transition” auction aims to allocate existing grid capacity to new renewable projects in Asturias and Galicia, regions impacted by coal plant closures. Priority will be given to projects that minimise environmental impact and maximise local socioeconomic benefits, such as job creation and investment in local industries.

In Asturias, a consultation phase has begun for the Narcea 400kV node, which has 362MW of capacity available following the closure of the Narcea coal plant in 2020. This capacity will be allocated to projects in Allande, Cangas del Narcea, Degaña, Ibias, Salas, and Tineo.

Additionally, a 59MW capacity at the 220kV La Pereda node, linked to the Mieres coal plant closure, will be distributed to projects in Aller, Lena, Mieres, Morcín, Ribera de Arriba, and Riosa.

In Galicia, the consultation phase is underway for a 408MW capacity at the Meirama 220kV node, following the closure of the Cerceda coal plant. This capacity will benefit projects in Carral, Cerceda, A Laracha, Ordes, and Tordoia.

In April, similar processes began for other nodes in Spain, including Garoña 220kV (Burgos), Guardo 220kV (Palencia), Lada 400kV (Asturias), Mudéjar 400kV (Teruel), and Robla 400kV (León). A new 400kV substation, Maciñeira, is also under construction.

MITECO noted that past renewable projects developed through similar tenders often led to additional industrial and service sector projects, generating more jobs than those lost due to coal plant closures.

The public consultation for these auctions will accept feedback until August 5th, 2024. The exact timeline for the auctions is yet to be announced.

In addition to providing grid capacity, the Spanish government supports energy storage projects through other initiatives. The PERTE program offers grants covering 40-65% of project costs for nearly 2GWh of storage projects.

Recipients include Iberdrola, Naturgy, Enel Green Power, and Fotowatio Renewable Ventures (FRV). These projects are expected to drive grid-scale energy storage deployments, many of which will be operational by 2025.

Industry experts, such as Patrick O’Connor from Cero Generation, suggest that co-located PV and battery projects in Spain are on the brink of commercial viability, driven by market volatility and decreasing battery costs.

Speaking to Energy Storage News, O’Connor said: “In Spain we are leaving space on our solar projects for storage, but we don’t want to hold up the progress of the solar, so we will run a financial close process for the PV.”

This trend is expected to make BESS projects In Spain increasingly attractive in the near future.

Don’t miss Solar & Storage Barcelona this November for all things energy storage in Spain and beyond.