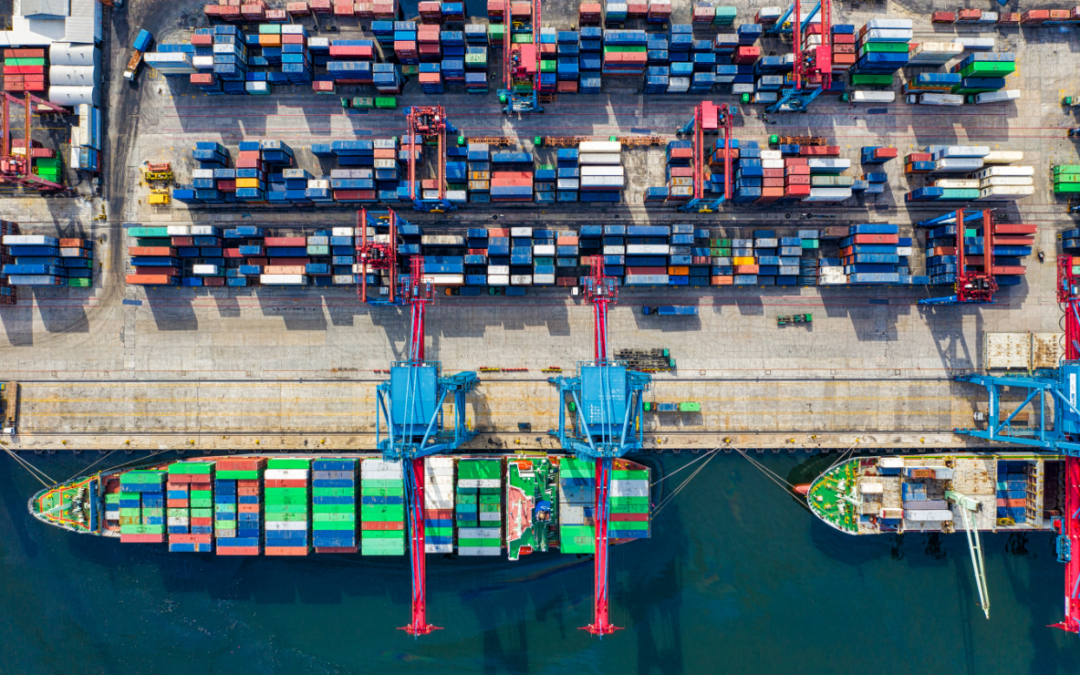

The US Commerce Department has announced a new round of tariffs for solar panel imports from Southeast Asia.

Considered to be part of the US’ anti-dumping drive, Reuters reports that analysts were not surprised by the decision. They are anticipating cut profit margins for producers and higher consumer prices.

According to Reuters, the new round of tariffs is the second determination in a trade case brought forward by Hanwha Qcels, First Solar, and more – who have raised concerns about Chinese companies selling solar parts to the US undercutting market prices.

Citigroup (Citi) analyst Pierre Lau explained his belief that the tariffs would improve production in the US solar industry and reduce reliance on imports.

He adds: “PRC module makers generally think the impact limited near term, assuming much of the incremental cost would be passed through to US customers without alternatives.”

Relocation

However, Yana Hryshko, Head of Global Solar Supply Chain Research at Wood Mackenzie, warns that, following the new tariffs, producers may source from countries such as Laos and Indonesia instead of China.

Speaking to Reuters, Hryshko adds: “They want to stay competitive for the U.S. market. The actual manufacturing cost in Southeast Asia is not that high compared to the prices that they are selling to the United States.”

In line with this concern, Hryshko told Bloomberg in August that some Chinese manufacturers were looking to relocate: “The mood of the suppliers is to pack the lines, especially the cell lines, and move them to either Indonesia, Laos or the Middle East.”

Chinese-owned solar plants are already present in Indonesia and Laos, where the tariffs do not currently extend to, however, analysts believe that this may change if exports increase.

Numbers

The US’ solar imports hit a record-breaking $15bn in 2023, with 80% coming from Cambodia, Malaysia, Thailand, and Vietnam. However, the US only accounts for 4-10% of Chinese module manufacturers’ sales – according to Citi.

The US Commerce Department has calculated anti-dumping rates as:

- Vietnam: 271.28%

- Cambodia: 125.37%

- Thailand: 77.85%

- Malaysia: 21.31%

A final decision, with possibly revised tariffs, will be released by the Commerce Department on 8 April 2025.