by Catie Owen | Jan 13, 2026 | Africa, Innovation, Press Release

Press Release

Solar & Storage Live Africa returns to Gallagher Convention Centre this March, uniting Africa’s energy decision-makers.

Set to be the largest edition in its history, Solar & Storage Live Africa returns to the Gallagher Convention Centre from 25 to 27 March, bringing together Africa’s most influential energy decision-makers, technology leaders and policymakers.

With strong demand from exhibitors, partners and visitors alike, Solar & Storage Live Africa 2026 reflects the growing urgency around energy security, grid resilience and decarbonisation across the continent. Thousands of professionals from utilities, government, mining, heavy industry, farming, commercial property, finance and the installer community will gather to explore practical solutions and forge partnerships that move projects forward.

Now in its 29th edition, the event has evolved into the definitive meeting place for Africa’s energy ecosystem. The 2026 event features an expanded exhibition floor, a strengthened conference agenda and a series of interactive features designed to support investment, collaboration and large-scale deployment.

The event is proudly supported by Eskom as Host Utility Partner, highlighting the importance of collaboration between public utilities and the private sector in strengthening South Africa’s energy system. Industry support is further reinforced by key partners including the South African Photovoltaic Industry Association (SAPVIA), the South African Renewable Energy Business Incubator (SAREBI) and the South African Energy Storage Association (SAESA).

The exhibition will feature more than 650 solution providers showcasing technologies across solar generation, energy storage, power electronics and smart energy systems. Confirmed exhibitors include global and regional leaders such as Huawei, Sungrow, Victron, Sigenergy, CATL, Herholdt’s, JA Solar and BYD Energy Storage, among many others actively delivering projects across Africa.

Complementing the exhibition is a comprehensive, content-rich conference programme addressing the most pressing issues facing Africa’s energy transition, from electricity policy and large-scale procurement to corporate decarbonisation and private-sector investment.

The 29th edition speaker line-up includes senior leaders from government, mining, manufacturing, property and renewable energy development, including:

- Mvumikazi Vimbani, Directorate: Electricity Policy, Department of Electricity &

- Energy

- Matthew Whalley, Managing Director, Green Living, Balwin Properties

- Franck Wandji, Group Executive: Commercial, ArcelorMittal South Africa

- Nishi Haripursad, Group Head of Environment, Sustainability Department,

- Harmony Gold

- Avesh Padayachee, Founder and CEO, Fibon Energy

- Gqi Raoleka, Co-founder and CEO, Pele Energy Group

- Thembani Bukula, CEO, PowerX

- Frank Spencer, CEO, SBG.Earth

Key show features for 2026

- Outdoor EV Showcase featuring electric vehicles, EV charging solutions and supporting technologies shaping the future of electric mobility.

- Deal-making on the expo floor, creating opportunities for partnerships, project announcements and commercial collaboration across the energy value chain.

- Startup Zone showcasing early-stage companies introducing innovative technologies, new business models and creative solutions for the energy transition.

- Installers University delivering practical, real-world insights into energy installation projects, from residential systems to large-scale commercial applications.

As part of the global Solar & Storage Live series delivered by Terrapinn, the Africa edition continues to play a critical role in driving investment, skills development and clean energy deployment across emerging markets.

Professionals from across the entire energy ecosystem, including utilities, policymakers, developers, investors, technology providers, installers and large energy users, are invited to attend and be part of the conversations shaping Africa’s energy future.

ENDS

Event details:

Solar & Storage Live Africa 2026

25–27 March 2026

Gallagher Convention Centre, Johannesburg

For further information and to register, please visit:

https://www.terrapinn.com/solarafrica

Media enquiries:

Manas Sahu

Marketing Manager

manas.sahu@terrapinn.com

Want to publish a press release? Submit your content here for review by our editorial team.

by Catie Owen | Jan 13, 2026 | Asia, Storage

Press Release

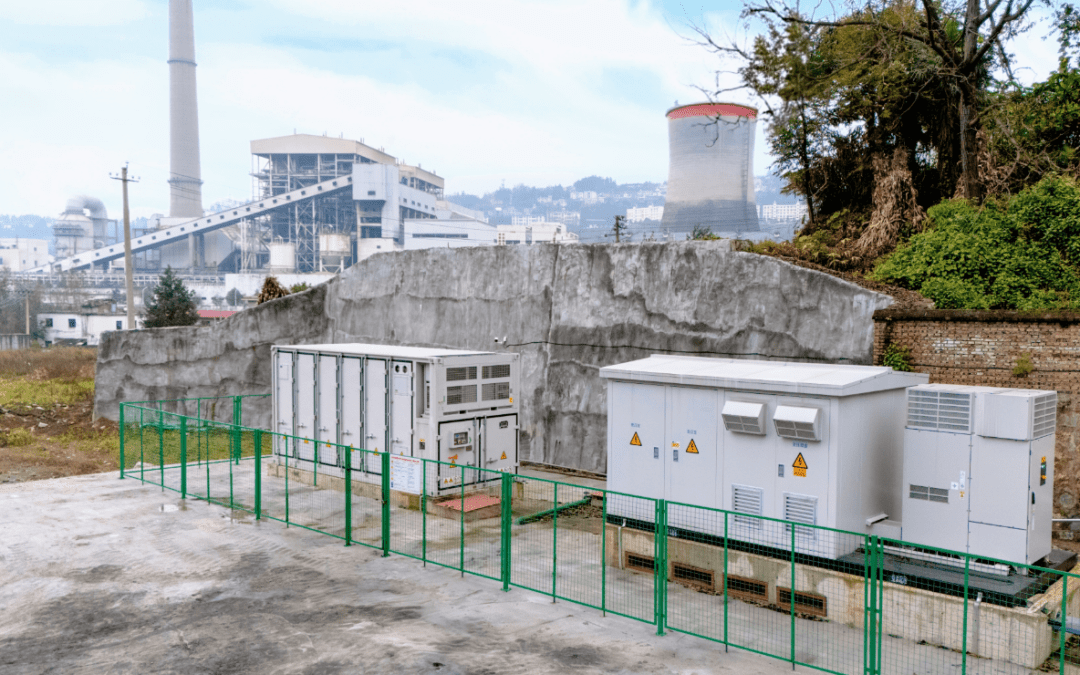

HyperStrong, in collaboration with Inovance, successfully commissioned a 2.5 MW / 3.343 MWh battery energy storage system (BESS) for a coal mine in China. The project has completed all testing and commissioning phases and is now officially in operation.

Designed specifically for the highly demanding and high-risk conditions of coal mining, the project represents a landmark application of electrochemical energy storage in the mining sector. It establishes a new benchmark for safety-oriented BESS deployment in industrial environments.

Coal mines are among the most dangerous industrial environments, where even brief power interruptions can rapidly escalate into serious safety incidents. By deploying advanced electrochemical energy storage solutions, HyperStrong ensures an instantaneous emergency power supply with higher reliability and safety.

The solution reduces maintenance demands, operational risks, and environmental impact while significantly strengthening the mine’s resilience against unexpected grid outages.

The project deploys HyperStrong’s flagship liquid-cooled battery energy storage system, featuring a highly integrated and flexible design with enhanced safety and operational efficiency.

Engineered for the special conditions of coal mines, including high temperatures, humidity, and heavy dust. The system features customised structural and protective enhancements to ensure long-term, stable, and reliable operation.

The system is developed in strict compliance with coal mine safety standards. It integrates mine-specific design and EMS control strategies, enabling rapid automatic switching to emergency operation during grid outages.

It ensures an uninterrupted power supply to critical safety loads, effectively mitigating outage-related risks and strengthening overall safety.

Truly valuable technology goes beyond performance metrics—it protects lives when it matters most. HyperStrong’s mining energy storage solution stands guard in high-risk, high-safety-demand scenarios, supporting stable operations and ensuring every miner’s safety during daily work.

HyperStrong will continue to advance its “Energy Storage + X” strategy by delivering scenario-driven energy storage solutions across a wide range of industrial applications, unlocking infinite possibilities.

Through continuous technological innovation and system-level optimisation, the company remains committed to building a safer, efficient, and intelligent energy ecosystem while supporting customers in reducing operating costs and improving energy efficiency.

[Image credit: HyperStrong]

Want to publish a press release? Submit your content here for review by our editorial team.

by Catie Owen | Jan 13, 2026 | Asia, Commercial & Industrial Solar

The Ministry of Finance and the State Taxation Administration announced on January 9 that China will remove value-added tax (VAT) export rebates for the photovoltaic (PV) industry starting April 1, 2026.

This policy shift marks a significant adjustment to the financial incentives supporting the country’s renewable energy exports.

The new regulations establish different schedules for solar and battery products. While solar rebates will vanish in a single step, the battery sector faces a two-stage reduction.

The adjustment affects a broad range of high-tech components. The solar category includes monocrystalline silicon wafers (specifically those with diameters above 15.24 cm), unassembled cells, and finished modules.

In the battery sector, the policy extends beyond standard lithium-ion packs to include all-vanadium redox flow batteries and essential upstream materials like lithium hexafluorophosphate and lithium cobalt oxide.

Market and industrial outlook

This marks the second major adjustment to the rebate structure in 14 months, succeeding a 2024 reduction from 13% to 9%.

Analysts indicate the update will increase export costs for Chinese PV and battery manufacturers, while some firms may advance exports before the deadline, potentially triggering a surge in shipments in early 2026.

The policy is intended to reinforce China’s industrial policy goals. These focus on industry consolidation and a move towards higher-value, more sustainable manufacturing rather than volume-based growth.

by Catie Owen | Jan 9, 2026 | Commercial & Industrial Solar, Europe, Large Scale Utility Solar, Market Reports, Storage

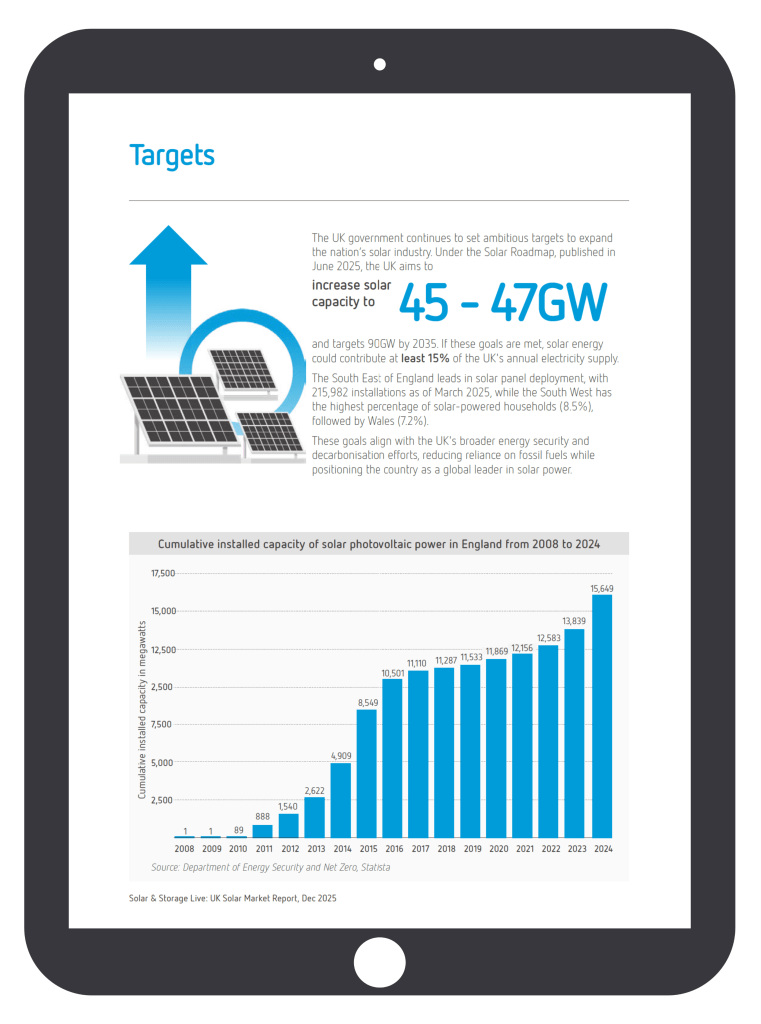

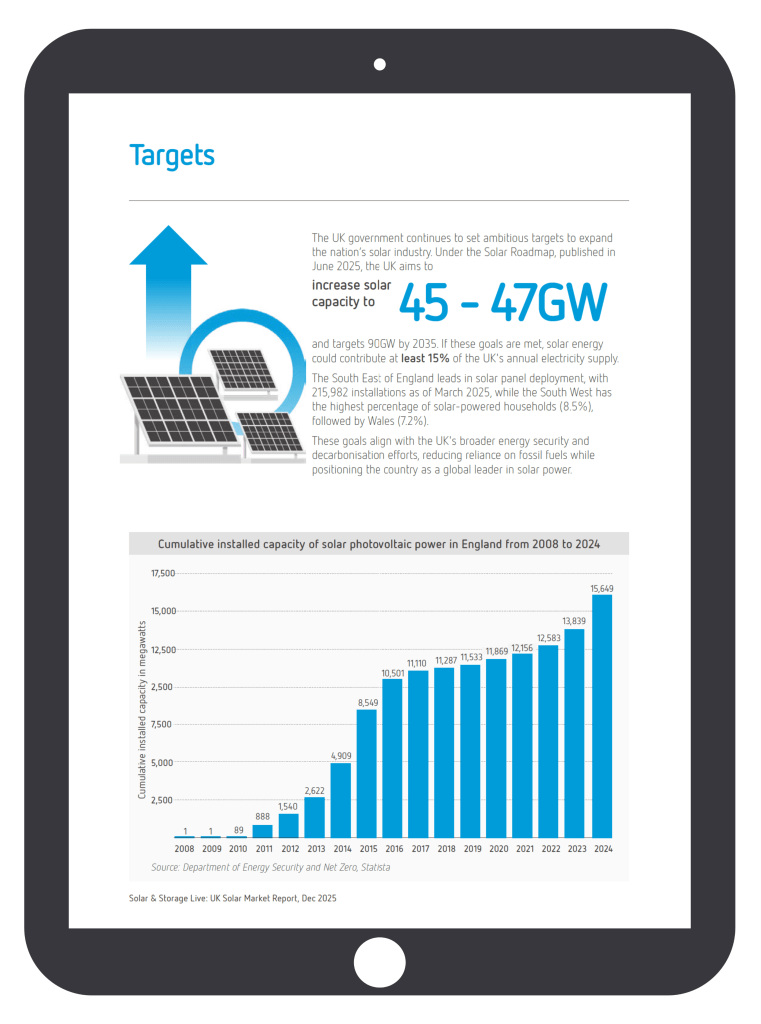

The UK solar market is accelerating rapidly, with capacity reaching 19.1GW in 2025 and over 1.8m installations nationwide.

Supported by the launch of Great British Energy (GBE) and a £200m investment in clean energy, the sector is central to Britain’s mission to become a renewable energy superpower.

Supported by the launch of Great British Energy (GBE) and a £200m investment in clean energy, the sector is central to Britain’s mission to become a renewable energy superpower.

To navigate this evolving landscape, Solar&StorageXtra presents The UK Solar Market Report 2026, produced by Solar & Storage Live ahead of another busy year of solar and storage shows.

This essential guide offers deep-dive insights into the UK’s 6.8GW battery storage market, forecasts for utility-scale deployment, and the latest trends in commercial and residential solar.

Stay ahead of the UK’s clean energy transition.

Get your free copy of the UK Solar Market Report 2026.

Download the Report

We’re kicking off the year with Solar & Storage Live in London, so don’t miss out on your free ticket to the UK’s largest solar and storage show. Or, find a Solar & Storage Live event near you.

by Catie Owen | Jan 8, 2026 | Europe, Large Scale Utility Solar, Storage

In 2025, renewable energy accounted for 55.9% of Germany’s net public electricity generation, matching the previous year’s share.

According to data from the Fraunhofer Institute for Solar Energy Systems (ISE), wind remained the primary producer, while photovoltaics (PV) rose to second place, overtaking lignite for the first time.

Renewable performance and targets

Wind power generated 132TWh, a 3.2% decrease from 2024 due to poorer wind conditions. Sector expansion remained below national targets, with only 68.1GW of the planned 76.5 GW installed.

Conversely, PV production grew by 21% to approximately 87TWh. This shift aligns with a broader EU trend where solar generation surpassed the combined total of lignite and hard coal for the first time.

Total renewable generation reached 278TWh, falling short of the 346TWh target set for 2025. This shortfall is largely attributed to the slow expansion of onshore and offshore wind.

Furthermore, while solar capacity reached 116.8GW, the sector requires 22GW of new installations in 2026 to meet upcoming targets.

Storage and system impacts

The battery storage sector saw significant growth, with large-scale capacity increasing by 60% to 3.7GWh. Leonhard Gandhi, project manager at Fraunhofer ISE, noted the significance of this trend:

“The ramp-up of large-scale battery storage is fundamentally changing the way the German electricity system works. While effects on short-term flexibility provision are already visible, systemic impacts, e.g., on reserve power plants, can only be estimated at this stage.

“These developments require battery storage to be explicitly considered for expansion planning, system planning, and electricity market design.”

Generation from fossil fuels stagnated as rising natural gas consumption offset a 3.9TWh decline in lignite production. Consequently, carbon dioxide emissions remained stable at 160m tons.

In the trading sector, Germany’s net import surplus fell to 21.9TWh. This decline was driven by lower gas prices and higher electricity exchange prices, which averaged €86.55/MWh – a 10.9% increase over 2024.

Looking ahead

While the 2025 data showed rising exchange prices, 2026 is expected to see a “subsidised decline” in consumer costs.

In November 2025, Germany confirmed an Industrial Power Price Subsidy, which went into effect on 1 January 2026. This will cap industrial electricity prices at 5 cents per kWh, with an aim of protecting energy-intensive sectors like steel and chemicals.

Furthermore, the German battery industry’s rapid growth underscores the nation’s role as a European storage hub. As Germany’s total renewable energy generation has fallen, we may see a shift towards even greater investment in the country’s storage sector.

[Graph credit: Fraunhofer Institute for Solar Energy Systems (ISE)]

by Catie Owen | Jan 8, 2026 | Commercial & Industrial Solar, Europe

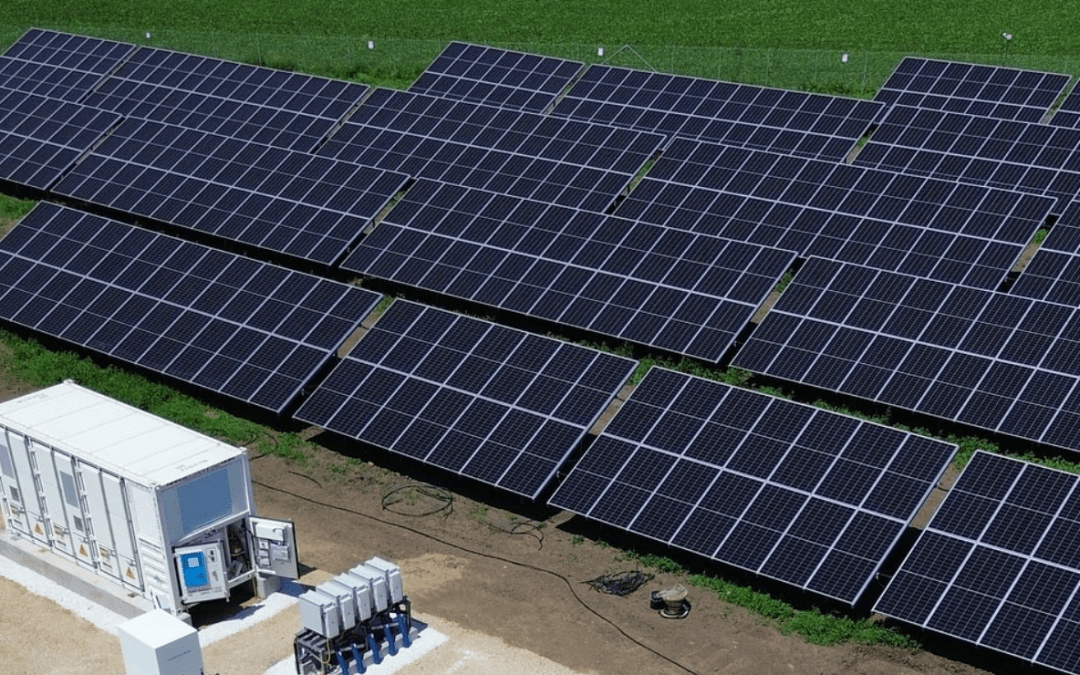

European Energy has reached a milestone of 2.1GW of grid-connected capacity in Denmark following the recent addition of the Glejbjerg Solar Park and a battery system at Kvosted Energy Park.

The portfolio, which spans solar PV, wind power, and battery energy storage systems (BESS), now accounts for more than 20% of Denmark’s total onshore renewable capacity, currently estimated at 8.8GW. Of this 2.1GW total, European Energy manages 2GW directly.

Maja Rasmussen, Country Manager for Denmark at European Energy, said:

“We have a strong development portfolio across Denmark, with many solid local partnerships, which only become an asset to the green transition if the projects are actually built and brought into operation.

“With this achievement, we demonstrate our ability to deliver. We look forward to continuing to support local and national climate and energy targets.”

Future demand and infrastructure upgrades

Data from the Danish Energy Agency suggests that electricity consumption in Denmark will double by 2040, necessitating further expansion of the nation’s renewable infrastructure.

In response to these market conditions, European Energy’s 2026 strategy focuses on upgrading existing assets by integrating battery systems. These additions are designed to provide flexibility, allowing renewable assets to store electricity for use during periods of low solar and wind generation.

Poul Jacobsen, EVP and Head of EPC at European Energy, emphasised the technical coordination required for such growth, stating, “Bringing assets from development into stable operation requires strong coordination across engineering, construction and asset management.”

He further observed that “Our experience in Denmark shows how assets can continue to evolve after commissioning, including through battery integration and other technical upgrades. This ongoing optimisation supports both long-term operations and the economic performance of the portfolio.”

The company’s Danish build-out includes more than 40 projects commissioned between 2013 and 2025. Moving forward, the firm continues to prioritise system optimisation and cooperation with local municipalities and stakeholders.

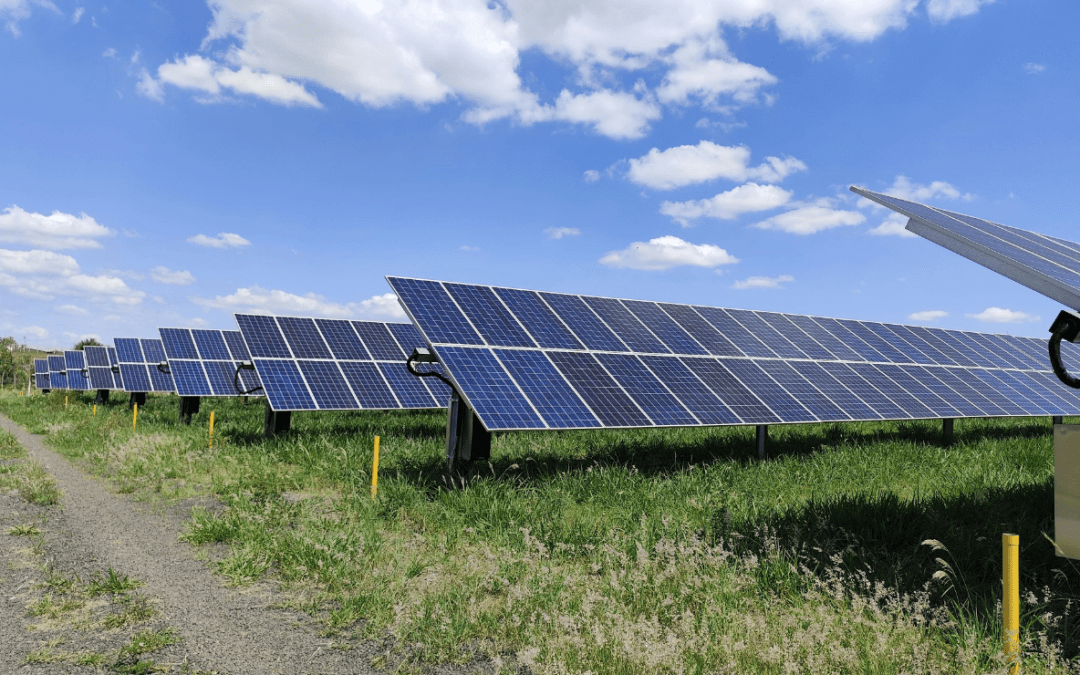

[Image caption: Glejbjerg Solar Park. Image credit: European Energy]

by Catie Owen | Jan 7, 2026 | Commercial & Industrial Solar, Europe

Orrön Energy AB has announced progress across its greenfield platforms, securing grid connections in the United Kingdom and municipal approvals in Germany.

Following the conclusion of the UK grid reform process, the company has secured connections for six large-scale projects with a combined estimated capacity of 2.9GW.

The UK developments include three solar energy projects totalling 1.8GW and three data centre projects with a combined capacity of 1.1GW. With land and grid connections secured, these projects have reached the ready-to-permit stage.

The company expects to receive binding grid offers and specific connection dates during the third quarter of 2026, at which point it will evaluate divestment options.

In Germany, three solar projects totalling approximately 250MW have received approval from local municipalities. Orrön Energy is also advancing a pipeline of large-scale battery projects and expects to receive grid confirmation early this year.

This follows a recent sales process where 310MW of projects were sold for a total consideration of MEUR 18, contingent on reaching specific development milestones.

Daniel Fitzgerald, CEO of Orrön Energy, commented: “Securing the Gate 2 grid connections in the UK enables us to move ahead with some of the discussions that were temporarily paused due to the now concluded grid reform process,” Fitzgerald said.

The company continues to mature its pipeline as part of its strategy to realise value from its development assets. Fitzgerald added: “The German platform has reached a level of maturity where project monetisation is underway.

“With an average sales price of around 55 TEUR (Thousand Euros) per MW during 2025, combined with the scale of our portfolio, I am confident that this will deliver significant value for us moving forward.”

by Catie Owen | Jan 7, 2026 | Asia, Commercial & Industrial Solar, Storage

LONGi Green Energy Technology Co. has announced a strategic shift to replace silver with base metals in its solar cell production.

The move comes in response to escalating costs and intense market competition, which have pressured the industry’s profit margins.

Mass production of these base-metal solar products is scheduled to begin in the second quarter of 2026. According to a company filing on 5 January, the transition is intended to “further lower the costs of solar modules.”

The economic pressure of silver

The solar industry has long sought to reduce its reliance on silver, but recent market volatility has accelerated these efforts. According to BloombergNEF, silver now accounts for 14% of the cost of solar modules, a significant increase from 5% two years ago.

The price of silver has seen a dramatic trajectory:

- 2025 performance: The metal’s price surged 150% last year, driven by demand from the tech sector, global uncertainty, and the US Federal Reserve interest rate cuts.

- Current market: As of Tuesday, silver prices rose over 5% to approximately $80.73, nearing the all-time high of $83 recorded in late December.

- Geopolitical factors: Some analysts attribute the recent spike to China’s new export restrictions and increased global uncertainty following the US’ capture of Venezuelan president Nicolás Maduro.

China’s export restrictions

China, a dominant global producer, has limited the number of companies authorised to export silver to 44, which some analysts believe may create a “local surplus”.

Other analysts have compared the situation to previous restrictions on rare earth minerals used to maintain control over critical resources.

The restrictions have drawn criticism from industry leaders, as the metal remains vital for high-growth sectors, including electric vehicles (EVs) and AI data centres. Elon Musk, CEO of EV giant Tesla, commented on his social media platform X: “This is not good. Silver is needed in many industrial processes.”

LONGi’s pivot

LONGi’s pivot is supported by its specific focus on back-contact (BC) solar cells. While “TopCon” technology currently holds a larger market share, LONGi maintains that BC cells are better suited for material substitution.

Beyond solar cell innovation, LONGi said in its Monday statement that it will expand its new energy storage business. The company plans to focus its storage efforts on the domestic Chinese market as well as Europe, the US, and Australia.

by Catie Owen | Jan 7, 2026 | Europe, Everything Installer, Large Scale Utility Solar

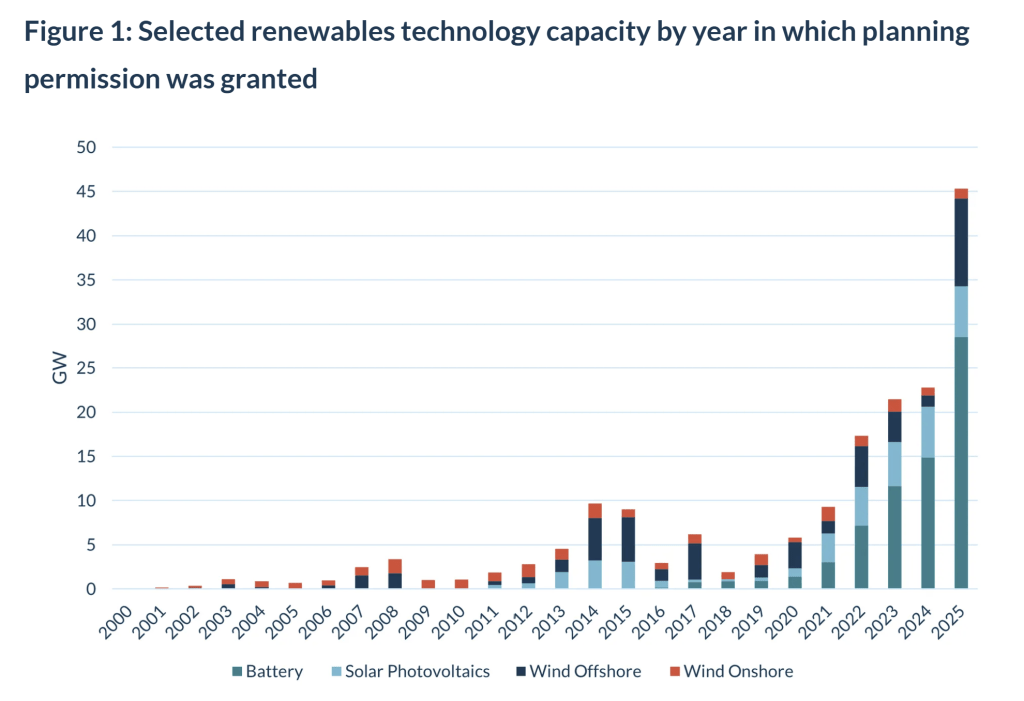

Planning approvals for battery, wind, and solar projects in the UK nearly doubled over the past year, with more than 45GW of capacity approved in 2025.

According to analysis from energy market intelligence service Cornwall Insight, this represents a 96% increase from the 23GW approved in 2024, providing enough potential capacity to power 12.9 million homes.

The growth is primarily due to battery storage, which rose from 14.9GW to 28.6GW in 2024, and offshore wind, whose approvals jumped from 1.3GW to 9.9GW. This shift follows a 400% increase in approvals since 2021.

Factors driving the surge include the maturity of battery technology and developers accelerating the adoption of applications ahead of network connection reforms. Government efforts to streamline planning through updated National Policy Statements have also been credited with reducing delays.

Despite the record numbers, industry experts warn of a gap between planning and delivery. Robin Clarke, Senior Analyst at Cornwall Insight, stated, “On paper, the UK’s renewables pipeline has never looked stronger.

“This record-breaking surge in planning approvals signals real momentum in the UK’s energy transition, with offshore wind and battery storage reshaping what’s possible at scale.”

However, Clarke noted that construction timelines and grid connection delays remain significant hurdles. “Approvals alone don’t generate electricity, and we urgently need to move from ambition to actual delivery of these projects.

“Too much capacity is still stuck in queues or waiting on grid upgrades. Grid bottlenecks remain one of the biggest risks to turning today’s approvals into tomorrow’s power.”

While reforms from NESO and the Planning and Infrastructure Bill aim to address “zombie” projects and legal challenges, Clarke emphasised that further action is required. “The recent grid connection reforms are a significant step forward, and should help clear some of the backlog, but they won’t solve everything.

“We need faster decisions, more investment in the grid, and real collaboration between Government, regulators, and industry. Without that, these record numbers risk becoming just another statistic.”

[Graph credit: Cornwall Insight]

by Catie Owen | Jan 6, 2026 | Americas, Commercial & Industrial Solar, Everything Installer

The return of Donald Trump to the White House created seismic changes to the geopolitical energy landscape throughout 2025.

To many onlookers, it seems that 2026 will continue in kind; the USA’s strikes on Venezuela indicate an escalation of the administration’s pro-fossil fuel agenda.

Background overview

January 3rd 2026 saw the US enact a military and economic takeover of Venezuela – arresting controversial president Nicolás Maduro – with Trump stating that the USA will “run” the country for an indefinite amount of time.

Pundits argue that the move is most likely a play at obtaining Venezuela’s oil reserves, which are the world’s largest. Notably, Trump’s press conference following the incursion focused heavily on Venezuela’s “badly broken” oil infrastructure alongside his desire to stabilise the country.

Why Venezuela?

Venezuela sits on more than 300 billion barrels of oil, which make up almost one-fifth of the world’s stock. However, since the 1970s, production has declined from 8% of global supply (around 3.5m barrels per day) to under 1% as of 2026 (under 1m bpd)

As such, increasing oil production in the country offers lucrative benefits for stakeholders.

Trump’s self-proclaimed plan is to introduce US oil companies to Venezuela’s reserves to “revitalise” the infrastructure: “The oil business in Venezuela has been a bust, a total bust for a long period of time,” he claimed at the press conference.

“We’re going to have our very large United States oil companies, the biggest anywhere in the world, go in, spend billions of dollars, fix the badly broken infrastructure, the oil infrastructure, and start making money for the country.”

A spotlight shines on US oil companies

Currently, one US energy company is operating in Venezuela – Chevron. “We continue to operate in full compliance with all relevant laws and regulations,” the company commented in response to the news.

US oil and gas producer ConocoPhillips stated that it is “monitoring developments in Venezuela and their potential implications for global energy supply and stability,” but that it would be “premature to speculate on any future business activities or investments.”

Eyes are on both major US and international energy companies to see if they make their stance on the oil-driven incursion clear.

The US goes “all-in” on fossil fuels

Xtra has previously reported that re-prioritising fossil fuel production is a clear pillar of Trump’s domestic policy. In the president’s inaugural speech, his intention to reinforce the US’ oil industry was encapsulated by his line “we will drill, baby, drill”.

Oil was at the core of 2025’s “Big Beautiful Bill”, which was followed by a tightening of clean energy tax credits and cancellation of grants for renewable projects. The US’ solar industry found itself particularly targeted.

By securing Venezuelan oil, Trump will receive ample fuel for the US’ future power projects and reduce the price of oil domestically. The US will additionally be able to control international access to Venezuela’s oil, to the benefit and detriment of other nations.

Impact on renewable energy

The implications for the renewable sector will be top-of-mind for international developers for several reasons.

American market volatility

Domestically, the “Big Beautiful Bill” continues to create a climate of extreme uncertainty. The US renewable industry relied heavily on the long-term certainty of the now-repealed Inflation Reduction Act (IRA), which provided major clean energy tax credits.

If more subsidies are gutted in favour of a “fossil-first” policy supported by cheap oil imports from Venezuela, many capital-intensive solar and wind projects may no longer be bankable.

International market changes

Internationally, a surge in Venezuelan production could lead to a global oil overabundance. Countries may find it more politically and economically convenient to invest in cheap oil rather than in more expensive green infrastructure.

Should oil begin to undercut the cost of clean energy in this way, the industry will likely see an increase in the cancellation or defunding of green projects worldwide.

Additionally, if the US retreats from clean energy production and manufacturing, the resulting market vacuum will be open to another major renewable power. Nations with an ever-expanding clean technology manufacturing industry, such as China, may be poised to increase their foothold further.

What now?

While Trump’s takeover of Venezuela may offer short-term relief for the US’ petrol prices, it places the global renewable industry at a crossroads.

The current US administration’s aversion to renewable energy is not new news to the industry; however, it leaves time for companies and countries alike to adapt to the situation.

While it presents an opportunity for oil and gas companies to capitalise on new supply, it also offers renewable stakeholders a chance to demonstrate leadership in pursuing renewables amid adversity.

It also serves as a reminder of the benefits of investing in renewable energy infrastructure: energy independence and security, and a cleaner climate.

[Header caption: Donald Trump delivers a press conference after ‘Operation Absolute Resolve’. Image credit: The White House]

by Catie Owen | Jan 6, 2026 | Asia, Everything Installer, Innovation, Press Release

Press Release

LONGi has been recognised by CDP, the global environmental non-profit, for its leadership in corporate transparency and performance on water security, securing a place on CDP’s respected annual ‘A’ List, and scored ‘B’ Management Level for Climate Change for the third year, demonstrating long-term commitment and professional expertise in water resource management as well as outstanding performance in sustainable development management.

Achieving an ‘A’ place LONGi among the global leaders demonstrates comprehensive disclosure, mature environmental governance, and meaningful progress towards environmental resilience.

CDP operates the world’s only independent environmental disclosure system and assesses thousands of companies each year. In 2025, nearly 20,000 companies were scored, out of more than 22,100 reporting through CDP’s platform. In 2025, 640 investors with $127 trillion in assets asked CDP to collect data on environmental impacts, risks and opportunities.

It evaluates companies’ depth of reporting, understanding of environmental risks, and evidence of best practice – including ambitious target-setting and verified action.

LONGi recognises that water is not merely an essential resource for production, but also a fundamental pillar for ecosystem health and community prosperity. LONGi has consistently integrated water resource management into the core of our corporate sustainable development strategy, establishing and implementing systematic water management policies that cover the entire process from production operations to the supply chain.

At the same time, we believe that transparent communication would earn stakeholders’ trust and help us jointly address global water challenges.

Since 2021, LONGi has consistently participated in the CDP Water Security and Climate Change questionnaires, disclosing its ESG management goals and progress. After LONGi achieved the leadership score (A-) in water security for the first time, we have continued to increase investments in water resource management.

Finally, in 2025, with outstanding leadership in water resources management, LONGi received the highest leadership score in the 2025 water security questionnaire for the second year and was included in the prestigious annual ‘A’ List.

In 2024, LONGi strengthened sustainable water resource management, improved water efficiency, and established water resource management policies and water-saving requirements to reduce wastewater generation and discharge.

During the operation, LONGi continues to optimise its water-use structure and advance water-stress assessments for the rational development and efficient utilisation of regional water resources through water-saving technological upgrades, wastewater treatment and reuse projects, and other related initiatives, improving water-resource efficiency at production sites while reducing wastewater discharge. In 2024, we conducted water resource risk assessments at all operational locations and formulated water-saving policies and plans, clarifying water-saving targets.

In 2024, the Group’s overall water use intensity target1 was to decrease 13.8%, compared to 2023, while the actual decrease was (meeting the target)24.8%

In addition, LONGi monitors the water footprint of products and has joined the LWFI1, collaborating with value chain partners to alleviate local water resource pressures. We establish water footprint management plans by product type, monitor product water-use intensity, and explore the construction of “zero wastewater discharge” factories.

In 2024, by analysing the water-saving potential of all production stages and employing alternative water measures such as grey water recycling, concentrated water recycling, and rainwater recycling, the reduction rate of water use intensity was considerably reduced in monocrystalline silicon, wafers, and cells compared to 2023, especially in the cell sector, with an actual reduction of 44.5%.

Water is the source of life and the core of sustainable development. LONGi will continue to uphold its commitment to water security with high standards, driving efficient water resource utilisation through technological innovation to protect every precious drop of water on this blue planet for a sustainable future for humanity.

Want to publish a press release? Submit your content here for review by our editorial team.

by Catie Owen | Jan 6, 2026 | Americas, Large Scale Utility Solar

Argentine renewable energy producer Genneia announced the launch of the San Rafael Solar Park in Mendoza at the close of 2025. The project represents a total investment of $180m.

The facility is Genneia’s third solar project within the Mendoza province. Equipped with 400,000 solar panels, the park possesses an installed capacity of 180MW. The project has already seen 140MW of capacity brought into immediate operation.

According to the company’s figures, the site will generate enough electricity to power approximately 135,000 homes – marking it as a significant addition to the regional grid.

In an official statement, the company highlighted the scale of the project: “This capacity makes it a benchmark for large-scale solar power generation, contributing significantly to the efficiency of the energy system.”

The San Rafael site is a central component of Genneia’s broader strategy to invest over $400m in energy projects across the province. The new farm is designed to supply electricity to private-sector clients via Argentina’s MATER marketplace, which serves large-scale power consumers.

by Catie Owen | Jan 5, 2026 | Americas, Commercial & Industrial Solar, Innovation

Alphabet, the technology conglomerate behind Google, has announced an agreement to acquire Intersect, an independent power producer that provides industrial-level projects with hybrid power generation.

The acquisition is for $4.75bn in cash plus the assumption of debt.

Google’s acquisition of Intersect is designed to increase the speed at which data centre and generation capacity come online. The deal includes Intersect’s workforce and several gigawatts of energy and data centre projects currently under construction or in development through an existing partnership with Google.

The news comes as companies expand their data centres to keep up with the increasing demand for accessible AI, with some looking to renewables to manage the technology’s vast energy consumption.

At the end of 2025, Google entered into a 21-year Power Purchase Agreement with multi-energy company TotalEnergies to supply renewable energy to Google’s Malaysian data centre.

Sheldon Kimber, CEO and Founder of Intersect, noted that “Modern infrastructure is the linchpin of American competitiveness in AI. We share Google’s conviction that energy innovation and community investment are the pillars of what must come next.”

Operational structure

Intersect will work closely with Google’s technical infrastructure team on joint initiatives, including a co-located data centre and power site currently under construction in Texas.

Sundar Pichai, CEO of Google and Alphabet, said: “Intersect will help us expand capacity, operate more nimbly in building new power generation in lockstep with new data centre load, and reimagine energy solutions to drive US innovation and leadership.”

Specific assets are excluded from the transaction, including Intersect’s existing operating assets in Texas and its operating and in-development assets in California.

These will continue to function as an independent company supported by its current investors, TPG Rise Climate, Climate Adaptive Infrastructure, and Greenbelt Capital Partners.

[Image credit: Intersect]

by Catie Owen | Jan 5, 2026 | Europe, Large Scale Utility Solar

Skyworth PV, a global provider of photovoltaic solutions, has finalised an agreement to begin construction on a 10MW distributed power plant in Ocre, a town in Italy’s Abruzzo region.

This development follows the steady progress of a separate 10MW project in Bordeaux, France, as the company seeks to expand its renewable energy network across European markets.

The execution of the Italian agreement “reflects the role of global renewable energy providers in supporting the worldwide energy transition through bankable, long-term solutions.”

Project specs and impact

Located near the border of the Lazio and Abruzzo regions, the 10MW facility is expected to generate approximately 14.059m kWh of electricity annually once completed.

The project has reached the “Ready to Build” (RTB) stage and has secured a position in the Italian government’s feed-in tariff auction mechanism. This status is intended to ensure future grid connection and long-term revenue stability.

The project is being implemented through a joint venture between Skyworth PV and a local Italian partner. Within this structure, Skyworth PV serves as the EPC contractor, responsible for the plant’s overall construction and the supply of essential equipment.

The company utilises this model to integrate its technical manufacturing and financing capabilities with the local partner’s understanding of regional regulations and resources.

This collaboration is designed to establish a “commercially sustainable model of shared risk, shared benefit and complementary strengths,” providing a scalable framework for cross-border partnerships in the clean energy sector.

The start of the Ocre project, alongside ongoing initiatives in France, marks a milestone in Skyworth PV’s efforts to provide reliable solar infrastructure.

By focusing on established markets with mature regulatory frameworks, the company aims to continue its role in the global energy transition and expand access to clean power through localised partnerships and advanced technology.

Interested in Italy’s solar market? Don’t miss your free ticket to Solar & Storage Live Italia – taking place 7-8 October 2026 at the Veronafiere exhibition centre.

by Catie Owen | Jan 5, 2026 | Commercial & Industrial Solar, Europe, Innovation

Swiss International Air Lines (SWISS) and the cleantech company Synhelion have entered into a long-term offtake agreement for sustainable aviation fuel (SAF).

Beginning in 2027, the airline will purchase at least 200 tons of solar-derived jet fuel annually.

The agreement establishes SWISS as the first airline to sign a binding five-year contract with Synhelion, supporting the commercial scale-up of synthetic fuel production. Under the partnership, SWISS acts as a customer, investor, and strategic partner.

“The partnership with Synhelion is a significant step for SWISS on the path to decarbonising our flight operations,” said Jens Fehlinger, CEO of SWISS.

“Sustainable aviation fuels (SAF) are a core element of our sustainability strategy. The offtake agreement with Synhelion sends a strong signal for innovation and responsibility in aviation.”

Creating synthetic solar fuel

In 2024, Synhelion inaugurated DAWN: calling the project ‘the world’s first industrial plant for the production of solar fuels’. The company creates Sustainable Aviation Fuel (SAF), solar diesel, and solar gasoline.

Synhelion’s solar fuel production process involves creating renewable synthetic crude oil, or “syncrude,” using solar heat energy and sustainable materials.

This syncrude is processed in existing refineries alongside fossil crude to produce certified Jet-A-1 fuel. The resulting fuel is compatible with current infrastructure and logistics chains, requiring no technical adjustments for delivery to airports.

Solar fuel can be produced and stored for when sunlight is unavailable, much like solar energy storage, giving the sustainable fuel an edge over fossil fuels.

“The fact that SWISS, a leading airline, has committed early on to adopt our fuels demonstrates confidence in the market readiness of our technology,” commented Philipp Furler, Co-CEO and Co-Founder of Synhelion.

“This partnership is a milestone for the commercial market launch of our fuels – and sets a powerful example to other airlines worldwide.”

Logistics

The partnership also involves logistics provider Kuehne+Nagel, which will purchase a portion of the solar fuel from SWISS. The fuel will be used for air freight via Swiss WorldCargo to help cargo customers reduce their carbon footprints.

This long-term agreement follows an initial delivery in July 2025, when SWISS used Synhelion’s solar fuel in regular flight operations for the first time.

That fuel was produced at Synhelion’s DAWN plant and refined in northern Germany before entering the supply system at Hamburg Airport.

[Image credit: Synhelion]

Don’t miss out on Solar & Storage Live Zürich, taking place 16-17 September 2026. Haven’t registered yet? Get your free ticket by securing your place here.

by Catie Owen | Dec 17, 2025 | Electric Vehicles, Europe, Everything Installer

Segen, a UK-based distributor of renewable energy products, has announced an exclusive six-month distribution partnership with EV infrastructure provider 3ti.

The deal focuses on the Papilio3, a rapid-deploy smart solar EV charging “FastHub” designed to bypass traditional installation barriers like grid constraints and lengthy planning processes.

Infrastructure and training

As part of the collaboration, Segen has installed a Papilio3 unit at its Training Academy and Distribution Centre in Medway, Kent. The facility trains approximately 1,600 individuals annually to address the national shortage of qualified renewable energy installers.

The Papilio3, constructed from an upcycled shipping container, features an integrated 20kWp solar PV array and can charge up to 12 vehicles simultaneously at speeds up to 22kW.

Because the unit is portable and free-standing, it requires no planning permission or major groundworks and can be installed in under a day.

James Galloway, Global Product Director at Segen Ltd, said:

“As a leader in the renewables sector, we are committed to setting an example by using innovative solutions to reduce our carbon footprint. At the same time, we aim to ensure that students have a rewarding and positive experience during their time at the Academy. Providing a convenient and sustainable onsite EV charging solution will help us achieve that goal.”

Market impact

The partnership aims to provide installers with a solution for commercial clients in sectors such as logistics, retail, and business parks. By utilising patented power-management technology, the FastHub operates using a site’s existing electrical infrastructure, removing the need for costly grid upgrades.

Beyond its charging capabilities, the hub includes integrated lighting, CCTV, and a roof cover for weather protection.

While currently serving Segen’s staff and trainees, the hub is also open to the public and nearby businesses, creating an additional revenue stream. The Papilio3 is currently available to order exclusively through Segen.

[Image credit: 3ti]

Get your free ticket to Solar & Storage Live London – the capital’s most exciting solar event. Or, find a Solar & Storage Live event near you.

by Catie Owen | Dec 17, 2025 | Commercial & Industrial Solar, Press Release

GoodWe is expanding the ET Series three-phase hybrid inverter with new models ranging from 80kW to 100kW, developed specifically for commercial and industrial (C&I) applications.

As a core product of GoodWe’s C&I energy storage portfolio, the ET 80–100 kW delivers higher efficiency and full-chain flexibility through enhanced power harvest and strong backup capabilities.

Seamless integration with GoodWe’s BAT 112 kWh high-voltage battery and Static Transfer Switch 125 kW (STS) positions the ET 80–100 kW as a leading choice for almost all C&I scenarios.

Full-chain flexibility & efficiency from DC to AC Side

The ET 80-100kW significantly increases energy harvest even in complex C&I scenarios, offering eight MPPTs with up to 42A input current, or 21A per string, making it compatible with M10 and M12 module sizes. AC and DC coupling offer great flexibility and efficiency.

AC coupling is ideal for adding storage to existing PV systems without changing the original PV wiring, MPPTs, cables or PV inverters, while DC coupling reduces conversion stages to cut energy losses and improve round-trip efficiency by more than 2%. Together, they enable flexible system configurations for different project requirements.

The ET 80-100kW has been engineered for flexible configurations and easy expansion over the project lifetime. Dual 110A independent battery inputs provide up to 220A charge and discharge capability, delivering the high power required for C&I peak-shaving, backup and fast response to load changes.

All-round safety, ultimate reliability

Safety and reliability are built into every layer of the hybrid inverter. The ET Series has been awarded the TÜV Rheinland Certificate for Comprehensive Environmental Adaptability, demonstrating its ability to operate reliably in challenging outdoor conditions.

The inverter features a smart fan reversal feature that automatically reverts direction of airflow during low power operation, reducing dust accumulation and corrective maintenance.

The ET Series inverter offers advanced features such as Arc-Fault Circuit Interrupter (AFCI 3.0) and Rapid-Shutdown Device (RSD) 2.0 for enhanced PV-side safety.

Terminal temperature monitoring on both AC and DC connections helps prevent overheating and ensures safe operation. Additional protections, including PV reverse polarity protection and ISO protection, guard the system from risks.

The smart DC circuit breaker option can be selected on a case-by-case basis and adds another layer of protection. It automatically trips in the event of reverse polarity, DC terminal over-temperature or internal short circuits, quickly isolating faults to protect both equipment and personnel.

Backup power and flexible expansion for diverse C&I scenarios

When combined with GoodWe’s STS 125kW, the ET 80-100kW delivers UPS-level switching with a transfer time of less than 4 ms, helping critical loads continue operation through grid disturbances without interruption.

The advanced smart port design of the STS 125kW supports multi-purpose use of a single port, including generator start-stop control and flexible switching between generators and large loads.

When paired with GoodWe’s high-voltage BAT 112kWh batteries, the ET 80-100kW forms an easy-to-deploy, optimally matched storage solution. This pairing allows the battery to discharge close to its maximum capacity and ensures high power performance.

As a truly scenario-ready solution, the ET 80–100kW is designed to serve a wide range of C&I sites. Ultra-low noise operation below 60dB enhances user comfort in noise-sensitive environments such as business parks, office campuses and public facilities.

Reverse rotating fans support dust removal and easy maintenance, making the inverter well-suited for dusty outdoor and industrial environments. The continuous peak output power (without grid) of 110 % and 150 % peak output for 10 seconds ensures strong performance with demanding and uneven C&I loads, including motors, compressors and other impact loads.

For larger projects, the ET 80–100kW can be paralleled in systems of up to 15 units via the SEC3000C smart energy controller. SEC3000C also enables mixed-parallel operation of the ET 80–100kW with GoodWe grid-tied inverters, giving more flexibility to expand with storage.

With STS 125kW, BAT 112kWh battery and SEC3000C, the ET Series 80–100kW offers a safe, efficient and flexible C&I energy storage solution that is ready to grow with customers’ future needs.

[Images credit: GoodWe]

Want to publish a press release? Submit your content here for review by our editorial team.

by Catie Owen | Dec 17, 2025 | Europe, Press Release, Storage

Press Release

In the capacity market auction held in December 2025, R.Power was awarded capacity contracts for five battery energy storage projects with a combined capacity of 1,012 MW and 4,032 MWh.

This further strengthens the company’s position as a leading provider of large-scale energy storage solutions in Poland.

R.Power announces new long-term capacity agreements for five utility-scale battery energy storage projects.

The portfolio includes Dzięgielewo with a capacity of 300 MW and 1,200 MWh, Czekanów with 300 MW and 1,200 MWh, Jawiszów with 202 MW and 808 MWh, Wysoka with 202 MW and 808 MWh, and Wrzosowa with 8 MW and 16 MWh, totalling 1,012 MW and 4,032 MWh. These projects will support the stability of an increasingly renewable power system and enhance the long-term security of electricity supply in Poland.

This outcome builds on R.Power’s successes in previous capacity market auctions. In 2024 the company had already secured contracts for four major BESS projects. These include Herby (5 MW and 10 MWh), Jedwabno (150 MW and 300 MWh), Tursko Wielkie (250 MW and 1 000 MWh), and Gdańsk (250 MW and 1 000 MWh).

Combining all BESS projects with capacity contracts secured, R.Power portfolio in Poland amounts to nine projects with a total capacity of 1 667 MW and 6 342 MWh.

“Reaching a total of around 6.3 GWh of contracted battery storage capacity marks an important moment for R.Power and for the Polish energy system. The scale of our storage portfolio now positions us among the leaders of the emerging BESS market.

“At the same time, we are seeing significant advances in battery technology, which enable the development of increasingly large and complex projects. We remain fully committed to delivering the flexibility solutions that the power system urgently needs,” said Przemek Pięta, CEO and co-Founder of R.Power.

[Image credit: R.Power]

Want to publish a press release? Submit your content here for review by our editorial team.

by Catie Owen | Dec 16, 2025 | Europe, Innovation

Italy has allocated over 1.1GW of solar capacity in a landmark tender reserved explicitly for projects that comply with the European Net Zero Industry Act (NZIA).

The results, published by the energy agency Gestore dei Servizi Energetici (GSE), reveal a highly competitive market ready to support European industrial capacity.

The tender, part of the transitional ‘FER X’ regime, required projects to use modules meeting strict EU manufacturing standards, effectively excluding Chinese-origin components.

Despite these supply chain constraints, demand was robust: 157 applications were submitted, totalling 1.84GW, with 88 projects ultimately securing support.

Competition

The selection process was driven entirely by price reductions, highlighting a market willing to squeeze margins to secure capacity. Successful applicants offered an average discount of 27.696% against the base operating price, with a maximum registered strike price of €73/MWh.

The most aggressive bids exceeded a 41% discount. Crucially, 34 projects – totalling 335MW – were deemed technically eligible but failed to secure funding simply because their offered discounts (mostly under 20%) were not competitive enough to enter the quota.

While small and medium installations were numerous, significant capacity was awarded to utility-scale projects exceeding 20MW, with some individual plants surpassing 100MW.

Geographically, the results confirmed a strong polarisation towards Southern Italy. Sicily secured most of the large-scale infrastructure, followed by Lazio, Puglia, and Calabria.

According to the GSE, this reflects the availability of suitable greenfield land and high solar irradiance in these regions.

Next steps

The publication of the rankings triggers a 36-month deadline for developers to bring these plants online. For the wider industry, this tender serves as a critical stress test for the EU’s solar manufacturing ambitions.

Interested in Italy’s solar market? Don’t miss your free ticket to Solar & Storage Live Italia – taking place 7-8 October 2026 at the Veronafiere exhibition centre.

by Catie Owen | Dec 16, 2025 | Europe, Innovation

EcoFlow has announced full compatibility between its advanced home energy ecosystem, including the EcoFlow PowerOcean Single-Phase system, and Intelligent Octopus Flux, Octopus Energy’s smart solar-and-battery tariff.

This integration builds on EcoFlow’s existing built-in support for the Octopus Agile and Octopus Flux tariffs in the EcoFlow app.

With the latest upgrade, customers can now connect to Intelligent Octopus Flux, allowing Octopus to automatically manage their EcoFlow system for optimised charging, exporting, and savings.

Once connected through the Octopus app, the Intelligent Octopus Flux tariff assumes complete control of the system’s charging and discharging behaviour. It charges the battery during the most affordable import windows, exports energy during high-peak-rate periods, and helps reduce daytime reliance on the grid.

EcoFlow stated that this “hands-free optimisation increases monthly savings, boosts export income, and delivers a faster and more predictable return on investment for households with solar and a battery.”

Craig Bilboe, EcoFlow’s Country Manager UK, IE, & ANZ, said: “Customers have been asking for EcoFlow to integrate with Intelligent Octopus Flux, and we’re thrilled to deliver it. EcoFlow already supported Agile and Flux within our app, but adding Intelligent Flux brings a new level of automation, safety-led optimisation, and financial benefit to UK households.”

The PowerOcean Single-Phase system, which forms a key part of the compatible ecosystem, features long-life LFP battery technology with more than 6,000 cycles, a dedicated fire prevention module, and a multi-layered battery management system.

Its IP65-rated design supports reliable outdoor installation, and the system offers a 15-year warranty. The system’s capacity is expandable up to 45kWh.

The company concluded that with full Intelligent Octopus Flux compatibility now live, users gain a “fully automated, high-efficiency, high-safety energy ecosystem that actively works to lower bills and enhance home energy returns.”

[Image credit: EcoFlow]

Supported by the launch of Great British Energy (GBE) and a £200m investment in clean energy, the sector is central to Britain’s mission to become a renewable energy superpower.

Supported by the launch of Great British Energy (GBE) and a £200m investment in clean energy, the sector is central to Britain’s mission to become a renewable energy superpower.