by Catie Owen | Oct 28, 2025 | Americas, Storage

Brazil’s Minister of Mines and Energy, Alexandre Silveira, met with leading Chinese energy companies on Friday, 24 October, as part of the Government’s visit to the 47th ASEAN Summit in Malaysia.

The meetings, which also include visits to Indonesia and Malaysia, aimed to attract international investment for Brazil’s first battery auction, expected to take place later this year.

In a statement on its official LinkedIn page, the Ministry of Mines and Energy said that Alexandre Silveira participated in a meeting with the Association of Southeast Asian Nations (ASEAN), of which Brazil is working to become a member.

According to Silveira, the auction will mark “a new cycle of modernisation and innovation in the Brazilian electricity sector.”

The event is hoped to enable the contracting of BESS that enhances the reliability of the National Interconnected System (SIN), supports greater integration of renewable sources such as solar and wind.

“We are preparing Brazil’s first battery auction, which will be crucial to ensuring the stability and efficiency of our electrical system,” said Silveira. “This is a historic step toward an even cleaner, safer, and more innovative energy matrix.”

During the meetings, companies including Huawei Digital Power, BYD, CATL, Envision, Sungrow, HyperStrong, and Hithium Energy Storage presented solutions and cooperation models focused on large-scale batteries and smart grids.

Silveira confirmed that the auction will take place under the Capacity Reserve Auction (LRCAP) framework, which guarantees available electrical power for the national system. This year’s edition will introduce a specific product for energy storage systems.

“Attracting investment to the battery auction is strategic for the future of the sector,” Silveira added. “We are paving the way for a new technological frontier that will bring innovation, jobs, and greater energy security to the country.”

The initiative underscores Brazil’s goal of drawing sustainable, high-value investments while advancing a fair and inclusive energy transition. It also aligns with efforts to strengthen Brazil’s position as a global renewable energy leader ahead of hosting COP30 in 2025.

[Image credit: Brazil’s Ministry of Mines and Energy (MME)]

by Catie Owen | Oct 23, 2025 | Everything Installer, Large Scale Utility Solar, Storage

As the UK solar and storage sector gathers momentum, Solar & Storage Live 2025 set the stage for conversations about innovation, infrastructure, and growth.

Among the exhibitors was Aaron Sallows, Divisional Director for sister companies Maintech Power and Dunamis, who shared insights into how the two firms are shaping the future of large-scale solar and storage.

From navigating the bottlenecks of grid connection approvals to tackling harmful SF6 in high-voltage switchgear, Aaron highlights the challenges and opportunities facing the sector.

What are the roles of Maintech Power and Dunamis in the solar-storage industry, and how do the two entities complement each other?

Aaron: Dunamis focuses as an ICP – an independent connection provider – up to 132kV, specialising in design, build and project management, with a particular focus and specialism in battery storage and solar PV. Both gridscale independent and co-located projects.

Maintech Power, the sister company to Dunamis, essentially has many of the boots-on-the-ground teams operating as high-voltage and low-voltage electrical contractors.

We complement each other very well: Dunamis would step in as the ICP contractor, particularly on larger projects, fulfilling the ICP design and build scope requirements and sometimes moving into the balance-of-plant electrical side, depending on the client’s contracting.

Maintech Power would then come in, boots-on-the-ground, to carry out the installation, working alongside Dunamis as a partner. We also sometimes carry that through into the warranty periods post-energisation.

With the growth in solar farms, wind farms, and BESS, what technological innovations or improvements in infrastructure are you most excited about?

Aaron: Personally, I’m excited about moving away from reliance on high-voltage switchgear containing SF6. SF6 is a hugely harmful greenhouse gas, and from my own experience with switchgear leaks, it has a massive detrimental effect on the environment.

Moving away from that – especially in low-carbon renewable technologies – really boosts the benefits of renewable energy from grid-scale solar PV and from BESS as well.

What are your views on the current UK policy and regulatory landscape for large-scale solar-storage? Are there areas that need reform?

Aaron: Without commenting on any specific policies or regulations, I think – as most people in the industry would agree – getting grid connections approved faster would help stimulate the industry.

That would mean more projects being built, and more grid-scale renewable energy and battery storage coming onto the networks.

I also think there’s a huge need for investment to upgrade infrastructure to handle the increased capacity required for these projects. Without that, we risk bottlenecking the industry and slowing delivery.

Where do you see the biggest growth opportunities for Maintech Power and Dunamis over the next three to five years?

Aaron: The biggest opportunities are in transmission projects at 275 kV and 400 kV. There’s huge interest there, but also a big shortage of skills to deliver those projects.

In the next three to five years, we want to explore this area and look at how we can deliver the 300–400 MW projects currently coming through.

What are you hoping to showcase at Solar & Storage Live this year?

Aaron: This year we have a joint stand, showcasing the strength and synergies of Dunamis and Maintech Power.

We’re two side-by-side businesses with a good reputation in the industry, but we don’t usually shout about it too much. A big part of being here is to network and raise brand awareness among attendees.

We also want to showcase our skills by bringing engineers and technical expertise to the show – talking in depth with people about their requirements, helping them feed into tender processes and procurement, and ultimately generating more work.

So far, we’ve had a good mix of people at the stand – suppliers and project opportunities at different stages, from early investment through to more advanced development. It’s been a really positive experience.

Missed out on Solar & Storage Live UK? Get your free ticket to Solar & Storage Live London – the capital’s most exciting solar event. Or, find a Solar & Storage Live event near you.

by Catie Owen | Oct 23, 2025 | Commercial & Industrial Solar, Europe, Storage

Aviva Investors has partnered with Irish energy-infrastructure specialist Astatine to launch a new industrial energy-transition platform targeting up to €800m of investment across the UK, Ireland and continental Europe.

The platform will focus on decarbonising hard-to-abate industries such as data centres, food and beverage, cement, pharmaceuticals and manufacturing. Technologies will include solar PV, battery energy-storage systems, substations, industrial heat pumps, heat-recovery systems, and electric vehicle infrastructure.

These systems may be installed directly on client sites or connected to national grids to deliver low-carbon energy.

The partnership launches with a 128MW seed portfolio expected to be operational within two years and a development pipeline exceeding 500MW. Aviva Investors will act as the majority shareholder, providing financial backing, while Astatine will lead on project development, delivery, and operations.

Angenika Kunne, Head of Infrastructure Equity at Aviva Investors, said:

“This platform is a truly innovative means of providing large energy users in hard-to-abate industries with a dedicated single partner which can provide access to a range of technologies, helping them to decarbonise their production processes.

“These energy sources are economical, resilient to fluctuating prices suffered by traditional energy sources and can help whole sectors manage their energy transition journey in a cost-effective way.”

Tom Marren, CEO and Co-Founder of Astatine, added:

“We are delighted to partner with Aviva Investors on this ambitious platform. Industrial energy users are under increasing pressure to reduce cost while delivering climate and energy security targets. By combining Aviva Investors’ financial strength with our development expertise, we can accelerate the delivery of projects to assist with increasing competitiveness for Europe’s industrial base.”

Kunne said the partnership offers “an opportunity to capture attractive returns in Europe’s industrial decarbonisation market”, praising Astatine’s track record and ability to deliver projects that “reduce energy costs and emissions”.

For the solar sector, the initiative signals continued momentum in on-site and grid-connected PV as a cornerstone of industrial decarbonisation – providing stable, cost-efficient renewable power to energy-intensive industries across Europe.

by Catie Owen | Oct 23, 2025 | Europe, Storage

Power systems in Central Europe are emerging as key players in the global energy transition through the rapid expansion of solar farms and locally made BESS.

A report by Ember was used by Reuters to analyse the findings.

Since 2022, countries including Austria, Hungary, Romania and Poland have sharply increased the share of electricity generated from solar farms to strengthen domestic energy supplies. This rise has driven fossil-fuel generation to record lows in 2025.

Solar growth has been matched by widespread BESS deployment, with many systems built locally and supported by job-protection policies. Together, these technologies are helping the region move away from legacy fossil-fuel infrastructure and towards cleaner, more resilient power systems.

Austria and Hungary lead this shift. Austria, once reliant on Russia for around 90 % of its gas, has drastically reduced Russian imports and now sources most of its gas from Slovakia. Hungary still purchases Russian oil and gas, but has lowered its gas-fired electricity from over 25 % before 2022 to below 20%.

In 2025, Austria generated about 17 % of its electricity from solar and 10 % from fossil fuels, compared with 6% and 19% in 2022. Hungary’s solar share has climbed to roughly 33%, with fossil generation down to 22%, from 14 % and 35 % respectively two years earlier.

Romania, Poland, Slovakia, and the Czech Republic have also expanded solar generation while reducing fossil-fuel use. Cumulative solar capacity across the five nations has risen by roughly 460 % since 2019, from 8 GW to more than 45 GW in 2024 – well above Europe’s 145 % average increase.

Battery storage is also accelerating. Between 2022 and 2025, Austria, Hungary and Romania boosted BESS capacity by about 472 %.

Project data indicates regional capacity could grow more than tenfold by 2030, reinforcing Central Europe’s role as a growing force in the global shift from fossil fuels.

[Infographic credit: Reuters]

by Catie Owen | Oct 21, 2025 | Europe, Innovation, Storage

With over a decade of experience in the UK’s energy industry, Mark Duxbury, UK Country Director of BESS and EMS Solutions at iwell, brings a deep understanding of how smart energy systems can accelerate the transition to a decentralised grid.

In this interview, he discusses why now is the right time for iwell’s UK launch, the critical role of battery storage and smart energy management in the clean energy transition, and how the company’s innovation is setting new standards for energy resilience.

iwell has established itself across the Netherlands, Germany, and Belgium before expanding into the UK. What made now the right time to launch here?

The UK energy market is in transition, moving from a centralised to a decentralised model. The inclusion of BESS & EMS is essential for this to happen effectively.

The archaic infrastructure of the National Grid means having to think outside the box when making changes to a site’s energy requirements – coupled with very high and volatile energy prices, this gives the ideal landscape for iwell’s solutions.

With growing confidence in UK cleantech, what role do you see for battery storage and smart energy management in building a more resilient, renewables-based grid?

It’s a crucial role. The energy transition has only just really begun, with decades of future progress needed to ensure the UK’s infrastructure can cope with the electrification of assets of all kinds.

How does iwell’s in-house energy management system give you an advantage in improving energy security, cost management, and renewable integration for businesses?

With over 300 projects now installed, we have refined and honed our EMS, using customer feedback to tailor the system to be able to maximise its effectiveness.

Having the in-house capabilities to make these improvements, rather than looking to a third-party provider to create the change, alongside all of their other clients’ requests, we have been able to accelerate our EMS to the forefront of what is possible.

As an exhibitor at Solar & Storage Live Birmingham, what feedback did you receive, and what key trends or concerns did UK stakeholders raise?

Combining BESS and EMS as a fully integrated solution, delivered by one in-house team, really sets iwell apart from the competition. Our EMS capabilities were very well received, with many follow-up conversations now underway with potential partners.

Looking ahead, what opportunities and challenges do you expect iwell to encounter as you grow your UK presence?

A partnership approach will be key to our growth and success. BESS & EMS are complex solutions that require considered modelling before installation, as well as a strong and reliable partner to manage the assets and optimise their performance.

At iwell we cover the full process, from design and modelling, through installation and then onto operation of the BESS & EMS. This gives our clients peace of mind that their site will continue to operate successfully, but in a more optimised way.

Missed out on Solar & Storage Live UK? Get your free ticket to Solar & Storage Live London – the capital’s most exciting solar event. Or, find a Solar & Storage Live event near you.

by Catie Owen | Oct 20, 2025 | Storage

Press Release

Rondo Energy has started commercial operation of the world’s largest industrial heat battery. A 100MWh Rondo Heat Battery (RHB) has entered daily automatic operation, powered exclusively by an on-site PV solar array and delivering continuous high-pressure industrial heat and steam to a fuel production facility in California.

The unit sets new records for the industrial heat battery industry in capacity, round-trip efficiency, and power supply. This 100MWh unit delivers a volume of heat equivalent to 10,000 home heating systems.

During the day, off-grid solar PV charges the heat battery, and the RHB delivers heat 24 hours a day.

After 10 weeks of operation, the project has achieved all milestones for daily automatic operation, performance, efficiency, and reliability, proving out Rondo’s unique design, which boasts storage temperatures over 1000°C and round-trip efficiency above 97%.

“The Rondo Heat Battery is now proven at industrial scale,” said Eric Trusiewicz, CEO of Rondo Energy. “We are already developing and operating heat batteries across four continents and five industries. Our customers are improving their competitiveness and slashing their carbon emissions at the same time.”

This Rondo Heat Battery is directly delivering steam alongside gas-fired boilers without changes to the facility. This project was delivered with zero lost-time injuries and is fully meeting all customer contract specifications.

By replacing gas consumption with the fixed cost of on-site solar power, the project reduces energy cost volatility, as well as reducing regulatory and carbon market exposure. The lower carbon intensity of the customer’s fuel products strengthens competitiveness in low-carbon markets.

Decarbonising industry at scale

Industrial heat makes up 25% of global final energy use, and industries from chemicals to cement rely on high-temperature heat. Rondo’s technology provides a simple and safe way for manufacturers to reduce costs and slash scope 1 emissions today.

Unlike heat pumps or electric boilers that need constant power, the Rondo Heat Battery charges using only the six lowest-cost hours of electricity per day – whether from off-grid solar or from the grid. Intermittent and low-cost hours of electricity are becoming available in electricity systems around the world, thanks to the deployment of solar & wind.

“The commercialisation of the heat battery represents yet another global inflection point for solar & wind power, said Andy Lubershane, Partner at Energy Impact Partners.

“Just as electric vehicles opened up the transport market to renewable electricity, heat batteries will open up an even larger new market, industrial heat, which accounts for roughly a quarter of global energy consumption. We’re thrilled that Rondo is leading the way.”

Simple, proven, safe

The Rondo Heat Battery’s storage medium uses only brick and wire – abundant, proven materials that can’t catch fire, explode, or cause toxic leaks.

Heat batteries replace or drop in alongside industry-standard boilers and seamlessly integrate into existing steam flanges, delivering steam at any conditions at 100+ bar (1450+ PSI). Because it produces no emissions, the Rondo Heat Battery requires no air permits, easing deployment.

Global scale, ready now

Rondo is already developing and operating projects across North America, Europe, Asia, and Australia, with deployments underway for chemicals, biofuels, food & beverage, and cement. The company’s technology scales quickly, requiring no scarce minerals and using only proven industrial components.

With the 100MWh Rondo Heat Battery now online, Rondo is demonstrating the future of industrial heat, power, and cogeneration – renewable, reliable, and cost-competitive.

[Image credit: Rondo]

Want to publish a press release? Submit your content here for review by our editorial team.

by Catie Owen | Oct 20, 2025 | Europe, Storage

EirGrid has opened a six-week consultation on its proposed procurement mechanism for Long Duration Energy Storage (LDES), aiming to enable the delivery of up to 500MW of storage assets capable of at least four hours’ continuous import and export by 2030.

The consultation, published on 13 October 2025, follows the Department of Climate, Energy and the Environment’s Electricity Storage Policy Framework (ESPF) and builds on EirGrid’s 2023 Call for Evidence on LDES.

Respondents to that call highlighted both the benefits of storage and the investment barriers created by revenue uncertainty.

EirGrid said LDES could “play an important role in supporting the transition to a highly renewable electricity system and the delivery of Ireland’s Climate Action Plan targets.”

The operator’s proposal is for a technology-neutral mechanism that complements, rather than replaces, existing market arrangements such as the Capacity Remuneration Mechanism and DS3 System Services.

The initial phase would procure a minimum of 201MW of LDES capacity, prioritising connection types that maximise use of existing infrastructure and projects located in areas of high renewable dispatch-down.

“Such assets can help in providing both import and export flexibility to manage renewable variability,” EirGrid stated, “importing when renewable output is high and exporting back to the system when renewable output is lower.”

To encourage investment, EirGrid proposes a two-strand revenue model. Developers would bid a capped “floor price” based on the Levelised Cost of Storage, providing certainty of income.

Above that threshold, revenues would be shared 70:30 between the LDES operator and the Transmission System Operator.

The consultation also outlines an “operational envelope” system to ensure storage actions support, rather than worsen, grid constraints.

Responses are invited via EirGrid’s consultation portal until 17:00 on 24 November 2025, with a recommendations paper to follow for approval by the Commission for Regulation of Utilities. A second consultation will then address detailed contractual arrangements.

“Stakeholder feedback will be vital to shaping the final procurement design,” EirGrid said in its announcement on LinkedIn, encouraging developers, suppliers and network operators to participate.

by Catie Owen | Oct 17, 2025 | Commercial & Industrial Solar, Europe, Storage

Press Release

The company has launched the divestment process of one of its Romanian ready-to-build BESS projects – a 200MW / 400MWh facility.

The sale is part of R.Power’s strategy of asset rotation and portfolio diversification across different geographies.

Strategically located near Bucharest, a key hub of the Romanian energy system, the project will provide much-needed flexibility to support grid stability and accelerate the country’s energy transition.

R.Power is significantly scaling up its presence in Romania across both the photovoltaics and storage markets, supported by its physical office in Bucharest.

The company is about to energise its first PV projects in the country – Stalpu, Suseni, Dudesti and Punghina – and is preparing to begin construction of its first BESS project in Romania, the 254 MWh Scornicesti facility.

Romania will become R.Power’s third market with its own operational assets, following Poland and Portugal.

Energy storage is core of R.Power’s growth model representing more than half of R.Power’s overall 30 GW+ development pipeline across six European countries.

In Romania, company not only focus on standalone projects but also is preparing hybrid configurations that integrate BESS with both existing and planned photovoltaic farms.

Over the coming years, R.Power aims to expand its integrated capacity in Romania into the multi-gigawatt range, reinforcing the country’s role as a Central and Eastern European leader in the energy transition.

[Image credit: R.Power]

by Catie Owen | Oct 16, 2025 | Europe, Large Scale Utility Solar, Storage

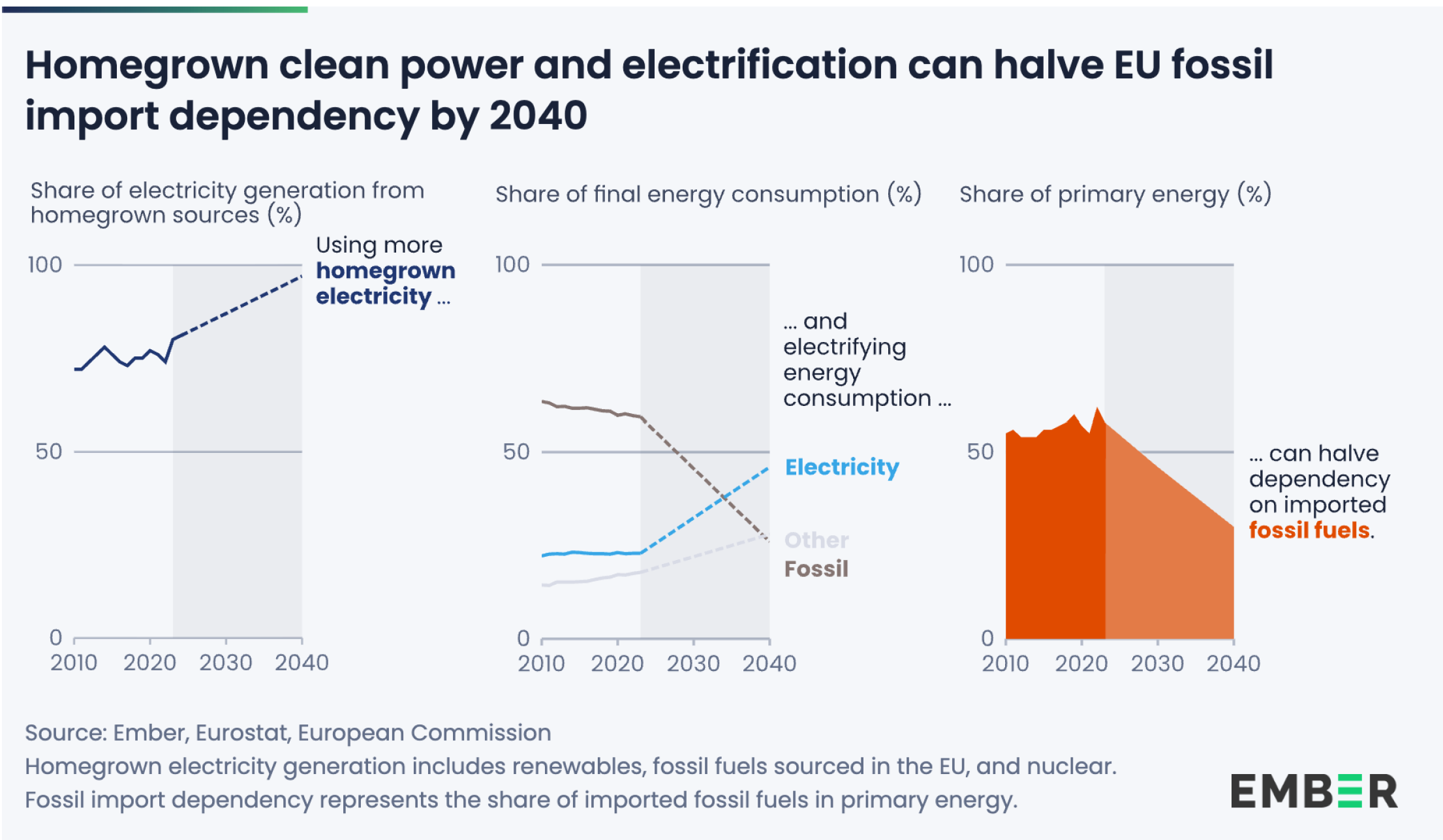

A new report from energy think tank Ember suggests that electrification powered by homegrown renewable energy – such as solar – could cut the European Union’s reliance on fossil fuel imports in half by 2040.

The study, Shockproof: How Electrification Can Strengthen EU Energy Security, argues that switching to electric technologies across transport, buildings and industry is key to improving energy security and reducing costs.

Currently, 58% of the EU’s primary energy supply comes from imported fossil fuels – a level of dependence far greater than that of China (24%) or India (37%).

Although reliance on Russian gas has decreased since 2022, the bloc now depends heavily on other major suppliers, including the United States, Norway and Qatar. According to the report, this concentration of supply leaves Europe vulnerable to price shocks and political pressure.

During the 2021–2024 energy crisis, the EU spent €1.8tn on fossil fuel imports – €930bn more than it would have at pre-crisis prices. In contrast, the report notes that electrification, driven by local wind and solar generation, could provide a more stable and affordable alternative.

The power sector already shows progress: only 19% of EU electricity generation relies on imported fossil fuels, compared with 88% in transport. Electric vehicles and heat pumps are helping to displace oil and gas imports.

Denmark’s EV fleet, for instance, reduced oil use by 11% in 2024, while Dutch heat pumps offset 10% of residential gas demand.

Study author and Senior Energy Analyst for Ember, Dr Chris Rosslowe, commented:

“Imported fossil fuels are no basis for a secure and affordable energy system – something Europe has learned the hard way. Homegrown energy sources, such as wind and solar, take on more strategic value in a world faced by frequent crises.

“The full potential of Europe’s homegrown power supply is being wasted by a lack of urgency to electrify. Unblocking electrification is the game changing move that can shield the continent from over-reliance on volatile fossil fuel suppliers.”

Despite some gains, just over one-fifth of EU energy demand is currently electrified. The report finds that two-thirds of remaining energy use could be converted using mature technologies, particularly in road transport and heating.

Ember’s policy recommendations include reducing electricity taxes, maintaining the 2035 combustion engine ban, and prioritising grid expansion to accommodate higher electrification.

The report concludes that “unblocking electrification” is Europe’s most effective route to energy independence, cost stability and decarbonisation.

[Infographic credit: Ember]

by Catie Owen | Oct 10, 2025 | Americas, Commercial & Industrial Solar, Storage

Nexamp has secured a three-year, $330m Construction Warehouse Facility (CWF) from a consortium of financial institutions to support the development and construction of around 20 new distributed generation projects.

The financing will provide flexible construction capital for Nexamp’s near-term solar and energy storage pipeline, with completed assets expected to transition into long-term financing structures such as tax equity or refinancing.

The company said this will help sustain renewable energy growth and strengthen domestic energy resources.

MUFG led the facility with a $200m commitment, serving as Mandated Lead Arranger and Administrative Agent. ING followed with $100m, taking on roles including Mandated Lead Arranger, Lender, Hedge Provider, and Green Loan Structuring Agent.

Siemens Financial Services contributed $30m as Joint Lead Arranger, while U.S. Bank National Association acted as Collateral Agent.

Zaid Ashai, CEO of Nexamp, said the transaction marks a major milestone in the company’s growth. “This facility underscores the strong confidence leading financial institutions have in our proven national platform,” he said.

“By securing flexible construction capital, we are better positioned to deliver the clean energy projects that communities across the country urgently need as demand rises. Solar continues to be the most cost-effective and easy-to-deploy source of new electricity, outpacing all other sources by a wide margin already this year.”

The lenders also emphasised the importance of the collaboration in supporting the clean energy transition.

“MUFG is proud to partner with Nexamp on this important financing, which advances our shared commitment to accessible, affordable energy,” said Takaki Sakai, Managing Director, Project Finance, MUFG.

“We are proud to support Nexamp with this innovative and sustainable financing solution,” added Filipe Barreto, Director, Renewables and Power, ING Americas.

Jim Fuller, Head of Project Finance at Siemens Financial Services, Inc., said: “At a time of increasing power demand, these projects will provide local communities with resilient clean energy.”

Nexamp said the transaction highlights the key role construction warehouse financing plays in expediting renewable energy deployment across the US.

by Catie Owen | Oct 6, 2025 | Commercial & Industrial Solar, Europe, Everything Installer, Large Scale Utility Solar, Storage

Press Release

Terrapinn are delighted to announce the latest addition to their global portfolio, Solar & Storage Live Italia, to be held at the Veronafiere during 8 – 9 October 2025.

Doors open on Wednesday 8th October, with 3,000 solar professionals expected to attend and headlined by a keynote address from Damiano Tommasi, Mayor of Verona.

Solar & Storage Live Italia is set to be Italy’s most exciting dedicated solar & storage trade exhibition, taking place for the first time in Verona, Italy. The event is organised by Terrapinn, with the support and cooperation of Veronafiere and Comune di Verona. It is supported at the highest level by sponsors Contact Italia, Failte Solar and Sunman, as well as renewable energy associations including ANIE Federazione, Kyoto Club, Legacoop, Elettricità Futura and the Global Solar Council.

The launch edition will bring together global and Italian suppliers Forniture Fotovoltaiche, ESPE, WiseGlow, Amara NZero, Chint PVSTAR, Huawei, Energy3000, Shanghai Elecnova Energy Storage Co., SolaX Power, who are among 100 exhibitors and innovative startups showcasing the latest solar and energy storage solutions.

With 3,000 attendees expected from across Italy, and high attendance from Verona and the Veneto region, it provides a one-stop destination for everything needed to deliver Italy’s commercial, industrial and residential solar and energy storage projects.

The event is free to attend and is a must-attend for installers, property owners, developers, landowners, and professionals working in the solar and energy sector who have registered on the website here.

The dynamic event format will provide Italy’s solar community with the opportunity to gather together to find suppliers and partners, and discover first-hand the tools, technologies and insights to grow their business, increase revenues and achieve energy independence.

Sean Willis, Managing Director, Terrapinn UK, comments:

“We’re thrilled to bring our successful Solar & Storage Live event formula to Italy and to launch another renewable energy exhibition that celebrates the technologies at the forefront of industry.

We’re excited to be opening our doors on 8th October, after a year in the planning, working with Veronafiere and our stakeholders, to realise this show. The co-location of events with McTER Expo provides an exciting new meeting place for the renewable energy sector. We are very pleased with the response and level of local support for the show.”

Event highlights

Exhibition: The event will convene key players from across the energy value chain, alongside pioneers and disruptors, to present the technology and service solutions essential for driving change in solar and storage. Headlining the event will be Platinum Sponsor Contact Italia, Gold Sponsors Sunman and Failte Solar, and Storage Theatre Sponsor Huawei.

Programme: The trade fair features four theatres and a comprehensive agenda covering a range of topic,s including large-scale utility solar, commercial and industrial solar, storage and batteries, and residential-scale solar installation.

Other features on the show floor: The Start-up Zone will feature 50 cutting-edge energy sector innovators and experts who can help deliver solar projects and make them a reality.

View more event highlights here.

Agenda highlights

The programme will commence from 10:00, Wednesday 8th October, with a keynote address from Damiano Tommasi, Mayor of Verona.

Over 150 speakers will participate in the extensive agenda across four stages, and you can expect to hear from representatives from some of the biggest and most innovative energy organisations based in Italy and globally. The programme is free to all event attendees registered for the event here

Leaders from the solar & storage industry will share their insights, case studies and expertise on critical subjects impacting the region, such as:

- Powering tomorrow: solar PV in 2025 and beyond, from solar parks to agrivoltaics and floating photovoltaics

- The role of energy storage in combination with other alternative renewable power sources

- Strategies and challenges in solar energy integration

- Financing projects and securing investment in the Italian battery market

- Raising public support for solar

View the full agenda here and speaker line-up here

Co-located with mcTER Expo

Solar & Storage Live Italia is co-located with mcTER EXPO – one location and two unmissable events for the renewable energy industry.

Opening times:

Wednesday 8 October: 09:30 – 17:00

Thursday 9 October 2025: 09:30– 17:00

Find out more about Solar & Storage Live Italia on our website here.

Want to publish a press release? Submit your content here for review by our editorial team.

by Catie Owen | Oct 3, 2025 | Americas, Large Scale Utility Solar, Storage

The Trump administration has announced the cancellation of $7.6bn in grants for clean energy projects across 16 states.

The funding supported more than 200 initiatives, including battery plants, solar farms, hydrogen projects, electric grid upgrades, and carbon capture efforts.

The decision was disclosed on Wednesday in a post by White House budget director Russell Vought, who said: “Nearly $8 billion in Green New Scam funding to fuel the Left’s climate agenda is being cancelled.”

The move comes amid an ongoing standoff between President Donald Trump and congressional Democrats over the federal government shutdown.

Cancelled projects

According to the Department of Energy (DOE), 223 projects were cancelled following a review that concluded they did not sufficiently advance US energy needs or were not financially sustainable.

The department stated the grants came from the Office of Clean Energy Demonstrations, the Office of Energy Efficiency and Renewable Energy, and other divisions.

One of the most significant cancellations involves $1.2bn allocated to California’s planned hydrogen hub. Governor Gavin Newsom’s office said the hub had attracted $10bn in private investment and warned that cutting the project could endanger over 200,000 jobs.

“Clean hydrogen deserves to be part of California’s energy future – creating hundreds of thousands of new jobs and saving billions in health costs,” Newsom said.

Senator Alex Padilla of California called the cancellation “vindictive, shortsighted and proof this administration is not serious about American energy dominance.”

Environmental groups expressed concern over the cuts. Jackie Wong, senior vice president at the Natural Resources Defence Council, said: “This is yet another blow by the Trump administration against innovative technology, jobs and the clean energy needed to meet skyrocketing demand.”

The states affected include California, Colorado, Connecticut, Delaware, Hawaii, Illinois, Maryland, Massachusetts, Minnesota, New Hampshire, New Jersey, New Mexico, New York, Oregon, Vermont and Washington.

Previous blows to solar

The news comes over a month since the administration’s August announcement that eligibility rules for clean energy tax credits were being tightened, threatening the country’s upcoming renewable projects. Solar, in particular, was highlighted.

August also saw the cancellation of the $7bn Solar For All programme, which was set to provide easier access to solar power for over 900,000 low-income households.

These targeted blows to the solar – and wider renewable energy – sector are part of a policy shift heralded by the signing of Executive Order 14315, Ending Market Distorting Subsidies for Unreliable, Foreign-Controlled Energy Sources, and the implementation of the One Big Beautiful Bill Act.

The motivation behind this shift is to re-prioritise fossil fuels, according to the US Department of the Interior.

by Catie Owen | Oct 2, 2025 | Europe, Everything Installer, Storage

Press Release

To celebrate their 15th anniversary, the inverter and smart energy solutions manufacturer GoodWe have announced a cashback campaign for installers in Europe.

The initiative runs for three months, from 1st of October to 31st of December 2025, covering selected residential GoodWe products, including hybrid inverters with batteries, All-in-One systems, EV chargers, heat pumps and carports.

Installers require membership in GoodWe PLUS+, the company’s European installer program, to be eligible, and need to make purchases through an authorised distributor.

Enrolment of the membership is available when making the claim and offers additional advantages, like warranty benefits, free technical training and loyalty awards.

“Installers are at the heart of GoodWe’s success. This campaign is our way of saying thank you as we celebrate 15 years together,” said Jie Zhang, Managing Director of GoodWe Europe GmbH.

“By combining strong cashback incentives with seamless access to our GoodWe PLUS+ community, we are strengthening our partnerships and helping installers grow their business.”

The GoodWe Smart Energy Ecosystem

GoodWe have expanded their product portfolio in the past years, offering smart energy appliances for modern homes, commercial & industrial (C&I) applications as well as utility-scale projects.

Their starting point and ongoing area of strength is in residential applications, where they have established a lineup of connected solutions.

Next to their innovative hybrid inverters and battery systems, the manufacturer produces lightweight solar panels for their solar carports, a line of heat pumps and water heaters under their GoodHeat brand, as well as their second generation of EV chargers.

This variety is reflected in the cashback campaign, covering the following products:

Hybrid Inverters & Batteries (purchased together)

ES G2 (3–6kW) or ES Uniq (8–12kW) with Lynx U G3 / Lynx A G3

ET G2 (6–15kW) or ET (20–30kW) with Lynx D

All-in-One Systems

ESA Inverter Module (3–10kW) with ESA 5–48kWh Battery Module

Residential Energy Products

Balcony ESA 0.8kW + BAT 1.9kWh

EV Charger HCA G2 (7–22kW)

R290 Air to Water Heat Pump

Hot Water Heat Pump

Carport Vela

15 years of renewable energy innovation

GoodWe was founded in 2010 and launched its first PV inverter for residential use in 2011. Within a few years, the company ranked in the top 10 of inverter manufacturers in China, offering multiple series of award-winning grid-tied products.

In 2014, GoodWe launched Asia’s first energy storage inverter and went on to earn a worldwide reputation as a top inverter manufacturer. With rising demand, GoodWe began establishing subsidiaries around the globe, including the GoodWe Europe headquarters in Germany.

Expanding their portfolio, the company funded additional business units for Building Integrated PV (BIPV) in 2020, Smart Energy in 2021, and opened a new factory for heat pump manufacturing in 2024.

In 2025, GoodWe is celebrating 15 years of innovation in solar PV and inverter manufacturing. The company is offering a product portfolio to cover and connect the energy needs of households around the world, transforming any building into a power plant to actively participate in the renewable energy revolution.

Full details, terms & conditions and claims form can be found here: https://emea.goodwe.com/cashback-2025

Want to publish a press release? Submit your content here for review by our editorial team.

by Catie Owen | Sep 30, 2025 | Asia, Innovation, Storage

A subsidiary of oil and gas company Reservoir Link has signed an agreement to jointly develop Malaysia’s first dispatchable solar PV plant.

Founder Group Limited, trading as Founder Energy, announced on 26 September that it had signed a head of agreement with Planet QEOS, an agricultural technology and energy group.

The deal will see a consortium led by Founder and Planet QEOS deliver a 310MWp ground-mounted solar PV plant in Baram, northern Sarawak, paired with a 620MWh battery energy storage system (BESS).

The project, named the Baram DeepTech Energy Program, is estimated to be worth RM1.16bn

According to earlier reports from Planet QEOS, partners in the programme also include Malaysian renewable energy firms EFS Energy and ES Sunlogy, along with China State Construction Engineering Corporation (CSCEC) and Chinese renewables provider Hopewind.

Sarawak deputy minister Datuk Gerawat Gala told The Star in August that the project would bring “round-the-clock renewable power to Baram…unlocking the full potential of the Baram hinterland for sustainable growth with improved connectivity, modern infrastructure, new industries, and skilled employment opportunities.”

The consortium will now seek regulatory approvals, financial close and definitive agreements, including power purchase contracts. Plans also include the development of a 200MW Tier-4 Green Data Centre Park in Baram, with Tier-4 being the highest reliability ranking for data centres.

Malaysia has been relatively slow in adopting large-scale storage, partly due to its stable peninsular electricity grid and natural gas resources.

However, renewable energy growth – needed to meet the country’s 2050 net zero goal – along with rising demand from data centres, is expected to increase the role of BESS.

by Catie Owen | Sep 29, 2025 | Americas, Storage

The United States added 5.6GW of battery energy storage from April to June, marking a record quarter, according to the American Clean Power Association (ACP) and Wood Mackenzie.

Utility-scale projects led with 4.9GW installed, a 62% year-on-year increase. The ACP said this is enough to power 3.7m US homes during average peak-demand hours. California, Texas, and Arizona each added more than 1GW, while Wood Mackenzie forecast Florida and Georgia as upcoming growth markets.

Georgia Power, for instance, recently issued a request for proposals for 500MW of grid-scale storage.

Growth may face challenges, said Allison Weis, global head of storage at Wood Mackenzie. “After 2025, utility-scale storage projects must comply with new, stringent battery sourcing requirements to receive the ITC [investment tax credit]. While domestic cell supply is ramping up, supply chain shortages are possible although developers are continuing to consider supply from China to fill in any gaps,” she said.

Weis added: “A rush to start construction under the more-certain near-term regulatory framework uplifts the near-term forecast. Projects that have not met certain milestones by the end of 2025 are at risk of exposure to changing regulations. There is additional downside risk if further permitting delays threaten solar and storage projects.”

The residential market also grew, adding 608MW in Q2, a 132% year-on-year rise. California, Arizona, and Illinois led installations, driven by higher attachment rates and larger-capacity systems.

According to EnergySage, California topped major markets with 79% of quoted projects including batteries, followed by Texas (61%) and Arizona (47%).

“Residential storage is expected to outpace solar due to stronger policy resilience, high attachment rates in key markets like California and Puerto Rico, and continued ITC access through third-party ownership,” said Allison Feeney, research analyst at Wood Mackenzie.

Community, commercial, and industrial storage added 38MW in Q2, up 11%. US storage is forecast to reach 87.8GW by 2029.

by Catie Owen | Sep 26, 2025 | Asia, Commercial & Industrial Solar, Press Release, Storage

Press Release

Global market intelligence provider S&P Global Commodity Insights has recognised GoodWe as Tier1 PV inverter supplier in their Cleantech Companies list for 2025.

S&P Global Commodity Insights uses a wide range of metrics to help developers, offtakers and other stakeholders make informed decisions in a crowded market with numerous new and old players.

The 2025 Tier1 assessment evaluated global manufacturers in six key dimensions: Market Presence, Market Share, Operational Capacity, Global Diversification, Financial Performance and Sustainability Metrics.

S&P Global Commodity Insights defines the relevance of their Tier list: “In today’s overcrowded, and competitive market, cleantech manufacturers must differentiate themselves to win contracts, while project developers seek reliable, reputable partners.

The Tier1 designation helps both sides of the market make informed decisions by spotlighting suppliers that surpass a threshold of rigorous, relevant criteria.”

Manufacturing with 15 years of experience

GoodWe is a world-leading manufacturer of inverters, battery energy storage systems (BESS) and smart energy solutions with a wide product portfolio and strong market presence. Established in 2010, the company offers products in the residential, commercial and industrial (C&I), and utility scale sectors.

GoodWe demonstrates a strong performance in all assessment areas of the S&P Tier1 list, having achieved over 100 GW of installations worldwide, covering the global market with 11 Subsidiaries and 27 sales and service centres.

The consistent success of the company in securing market share is based on product innovation and quality, delivered by over 1000 R&D professionals and continuous investments to drive generation and efficiency in renewable energy.

GoodWe is well-positioned to provide value to its customers, especially in the C&I sector, where battery and storage are opening new opportunities for companies to reduce energy costs, increase reliability of their infrastructure, and improve their environmental footprint.

With the recently launched BAT112 Series Battery and All-in-One ESA 125kW/261kWh storage products, GoodWe is offering solutions that have the potential to unite power generation and storage, supporting the grid and benefiting a wide variety of loads in the industry.

Sustainable solutions

Sustainability is a cornerstone in renewable energy technology and a key factor for customers around the globe. S&P Global included this dimension in its assessment, highlighting the relevance of ESG performance. As a provider of green technology, GoodWe is aiming to make power generation not only cheaper and more efficient, but also cleaner.

The company is practising environmental and social responsibility throughout the lifetime of its products. This begins with the sourcing of materials and components, extends through production and logistics and doesn’t end until the product’s end of life.

As a member of the United Nations Global Compact (UNGC) since 2021, GoodWe firmly practices the ten principles, covering human rights, labour standards, environmental protection and anti-corruption.

[Image caption: GoodWe Guangde Manufacturing Base. Image credit: GoodWe]

Want to publish a press release? Submit your content here for review by our editorial team.

by Catie Owen | Sep 24, 2025 | Europe, Storage

Press Release

EcoFlow, a global pioneer in portable power and home energy solutions, has officially opened its first UK headquarters in Birmingham, marking a major milestone in its expansion across the country.

The new office, located at the Bruntwood University Centre, was unveiled at an opening ceremony attended by the Mayor of the West Midlands, Richard Parker, who helped secure the premises for EcoFlow.

This was thanks to his participation in the UK’s largest trade mission to China over six years, to harness economic growth opportunities for the West Midlands.

The Mayor toured the new premises, delivered a short address, and welcomed EcoFlow’s investment in the region. UK-wide partners also joined the celebration, highlighting the strong network of collaboration EcoFlow has built in the UK.

EcoFlow’s arrival in Birmingham follows a period of immense growth in the UK market, with rising demand for both portable and residential energy solutions.

This year alone, the new headquarters will create 35 jobs across engineering, customer service, marketing, and business development – strengthening the company’s commitment to the UK and the region’s green economy.

Beyond job creation, EcoFlow plans to invest in the future generation of innovators by forming partnerships with local universities. The company aims to equip students with knowledge of renewable energy and cutting-edge technology, supporting skills development and inspiring careers in clean energy.

“Opening our Birmingham headquarters is not only a sign of our rapid UK growth but also our commitment to the region’s future,” said Ryan Xing, Managing Director of EcoFlow Europe.

“We are proud to be creating jobs in Birmingham, working with partners nationwide, and sharing our expertise with university students to inspire the next generation of clean energy leaders.”

Richard Parker, Mayor of the West Midlands, said: “EcoFlow’s investment proves that world-leading innovators believe in our plan to make the West Midlands a global leader in clean energy, including battery technology.

“This means good quality jobs now, and world-class opportunities for young people tomorrow. Just weeks after launching our Growth Plan it’s also a clear signal that we’re open for business and ready to welcome even more ambitious companies like EcoFlow who want to be part of a fast-growing, global market.”

EcoFlow will also join the West Midlands Global Growth Programme – a fully funded support package that offers international innovation-led companies a springboard to success in the region.

With its new UK base, EcoFlow is set to play a pivotal role in powering homes, communities, and businesses towards a net-zero future.

[Image credit: EcoFlow]

Want to publish a press release? Submit your content here for review by our editorial team.

by Catie Owen | Sep 23, 2025 | Europe, Press Release, Storage

EcoFlow today announced the launch of the EcoFlow Gateway (Single-Phase), a new central hub designed to unlock whole-home energy resilience.

The Gateway integrates multiple power sources, delivers seamless backup for the entire household, and simplifies installation, transforming home solar and storage systems into flexible, future-proof ecosystems.

“EcoFlow Gateway is the missing link between solar, storage, and smart-home technology,” said Craig Bilboe, Country Manage UK + IE at EcoFlow. “It delivers true whole-home backup, scales with household demand, and integrates with both renewable and traditional power sources – helping homeowners achieve genuine energy independence.”

Whole-Home Backup, Seamlessly Delivered

Unlike partial backup options, with up to 100A support, Gateway powers the entire home – from lighting and appliances to high-demand systems such as HVAC and EV charging. Outages trigger an uninterrupted switchover, ensuring zero disruption for households that depend on reliable power.

Flexible, Scalable, and Future-Proof

The system is fully scalable, supporting parallel configurations that expand capacity as energy requirements increase. By integrating with third-party solar inverters and connecting directly to generators, Gateway creates a versatile energy hub capable of supporting on-grid, off-grid, or hybrid living.

Faster Installation, Smarter Living

With direct main-panel connection and a built-in smart meter, Gateway significantly reduces installation time and complexity. Its RS485 and SG-ready interfaces enable smooth integration with smart-home systems and energy management platforms, giving homeowners greater control over how and when they use power.

Live at Solar & Storage Live Birmingham

EcoFlow will showcase Gateway at Solar & Storage Live Birmingham (stand C8). Visitors can experience the Gateway in action alongside EcoFlow’s full Home Energy Management System. Expert presentations will take place at 11:00 on the first two days of the event.

[Image credit: EcoFlow]

Want to publish a press release? Submit your content here for review by our editorial team.

by Catie Owen | Sep 22, 2025 | Europe, Market Reports, Storage

Discover the future of UK battery storage with the UK Battery Energy Storage Market Report 2025.

This essential guide charts the sector’s growth from early hurdles to over 440GWh of pipeline capacity and 22,000 new household systems installed last year.

It highlights market leaders, policy reforms, investment trends, and revenue opportunities across residential, commercial, and utility projects.

With analysis of planning, grid, and adoption challenges, plus forecasts on how storage underpins the UK’s net-zero ambitions, the report delivers actionable insight for investors, developers, policymakers, and suppliers.

Stay ahead in a rapidly maturing market – download the report and power your strategy today.

Download the Report

Don’t miss out on your free ticket to Solar & Storage Live London – the capital’s most exciting solar event. Or, find a Solar & Storage Live event near you.

by Catie Owen | Sep 16, 2025 | Commercial & Industrial Solar, Europe, Storage

Switzerland’s solar and storage sector is entering a new phase, with larger-scale projects and innovative business models beginning to reshape the market.

In the lead-up to Solar & Storage Live Zürich, we spoke with Luca Roccia, CEO of Gridsphere, about global technology trends, the future of storage innovation, and how Switzerland can carve out a leadership role in this fast-moving sector.

“Aggregating distributed energy storage systems also requires advanced EMS and aggregation platforms. These are already available in Switzerland and are improving rapidly.”

What have been the key global trends that have significantly influenced your approach in Switzerland?

For the past six years, we’ve been involved in energy storage globally. I’m originally from Italy, then I moved to the US to establish and develop business for a European-listed company. During that time, I’ve witnessed a lot of changes in the market.

From a technical perspective, when I first started in energy storage, lithium iron phosphate (LFP) wasn’t really present in the market. LFP has moved from niche to dominant for stationary storage in the last few years, offering a good price, long lifespan, and firm performance. At the same time, energy density increased significantly.

We are now at over 6MWh in a 20-foot container, whereas in the beginning, 1MWh was already considered a lot. The market has also shifted: from short-term to long-term energy storage, and from ancillary and stabilisation services to more solar surplus shifting.

I have seen this development both in the US and in Europe. In Switzerland, I recognise the same path I saw in other countries a few years ago, and I expect it to continue.

That is, in fact, what we are seeing now: larger and larger systems are being deployed. While there are already many residential storage units installed – and there will continue to be many – C&I and utility-scale storage are now growing.

We’ve already seen hundreds of hours with negative day-ahead prices in Switzerland (173 hrs in 2024, < − 5€ /MWh). That’s a strong signal that energy storage is required.

In the projects I’m following, both utility-scale and C&I, this revenue potential is already factored into the investment case.

To summarise: With 2026 ordinances enabling energy communities, minimum remuneration, and dynamic grid tariffs, the case for storage goes well beyond self-consumption.

Which emerging battery and storage technologies do you find most promising over the next decade?

LFP is absolutely the market leader, and I don’t believe that will change anytime soon. I expect LFP to remain the dominant chemistry.

What I do see, however, is hybridisation. In some large projects I’ve worked on, LFP batteries are combined with other technologies such as flow batteries. This enables both fast, powerful short-term response and longer-duration storage.

Beyond chemistry, I think one of the most important technical aspects is control systems and the ability to aggregate assets into VPPs (virtual power plants). Pools at Swiss utilities already exceed ~1.4 GW of aggregated flexible capacity.

Switzerland is very well positioned to take advantage of this opportunity, and we are already working on such projects with grid operators here.

What practical advice would you give developers and C&I clients in Switzerland looking to invest in battery storage now?

My first piece of advice is: look at the numbers. Use the actual data available and build models that provide reliable forecasts. When designing a system, it’s important to prepare for several types of services and build a revenue stack for the investment.

In Switzerland, demand charges are measured on 15-minute peaks, so right-sizing C&I storage against those windows is critical.

For example, in a C&I application behind the meter, you can increase self-consumption. You can also carry out peak-demand reduction for the customer, plus local grid support for the DSO. (Swissgrid) And, of course, there are services for Swissgrid, such as ancillary services (FCR, aFRR, mFRR) that batteries can provide.

We help developers and investors determine the best technology to deliver these services. I often say that there are OEMs and battery manufacturers with hundreds of megawatt-hours of projects successfully deployed worldwide.

Of course, we want to involve the Swiss ecosystem in developing storage systems, but we also need to learn from proven international technologies. Let’s not reinvent the wheel.

Could Switzerland become a global leader in energy storage innovation? What would need to evolve to make it happen?

Switzerland could certainly be a leader in innovation, but not in manufacturing. Nobody expects Switzerland to become a leader in producing batteries or turnkey solutions.

There are increasing challenges around cybersecurity, software, aggregation, and EMS. Switzerland can contribute expertise here, providing globally competitive systems with higher cybersecurity performance.

Aggregating distributed energy storage systems also requires advanced EMS and aggregation platforms. These are already available in Switzerland and are improving rapidly.

We are working with aggregators here to develop storage systems, and aggregators are key partners in our BESS-as-a-service projects—we operate via a prequalified BSP and integrate dispatch with the client’s BRP portfolio.

This involves distributed storage installed at C&I sites, aggregated to provide not only self-consumption but also grid services.

Talk to us about your BESS-as-a-service projects.

When you look at BESS assets as a standalone, the best you can do in C&I applications is increase self-consumption and offer peak-shaving for the customer. But that’s limiting, because storage can do much more.

The only way to enable more services – and more revenues – is to aggregate these systems and create VPPs that operate via a prequalified BSP and integrate dispatch with the client’s BRP portfolio.

That is the essence of the BESS-as-a-service concept we are launching: aggregating behind-the-meter storage at industrial facilities.

We apply acceptance criteria and select specific projects in Switzerland, then build a VPP to maximise revenues and profitability for investors.

Importantly, “as a service” means clients aren’t required to fully finance the storage investment themselves – different investment schemes bring in external investors to share the costs and benefits.

Can you give us a short insight into what you’ll be discussing on your panel at Solar & Storage Live Zurich?

From my experience with C&I batteries, the numbers are crucial. Without proper data analysis, you risk oversizing, undersizing, or making the wrong decisions. My first point will be: look at the numbers carefully.

Secondly, we need to be open-minded about revenue models. This ties into the BESS-as-a-service concept and the importance of aggregation into VPPs.

We’ll also explore how we expect the market in Switzerland to evolve, and what solutions we’re likely to see here.

Every country has its specifics: for example, in Texas, I’ve seen huge utility-scale projects, whereas in Germany or Italy, the market started with smaller residential systems before moving towards larger-scale projects.

Therefore, when sizing a project in Switzerland, we need to consider the country’s specific context. Our systems must not only meet current requirements but also be prepared for future changes in the market.